One of the most important things you can do for your financial life is to set goals. For many, this can be difficult because most of us have multiple financial goals in life. Some common ones I see are retirement, buying a house and paying down debt.

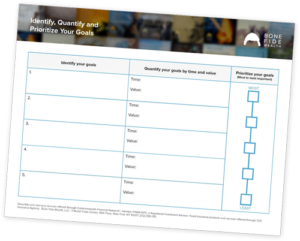

It can be tough to figure out what is most important and where to spend your money. However, goal priority can help simplify your decision. I’m going to break down the basic steps of goal setting because simply saying “I want to have a million dollars” is a pretty weak goal. When do you want to have $1 million by? What is this money for? Purpose is important so you need to be specific with your goals. You can also download the Financial Goals Worksheet below to help guide you through this process.

How to Set Financial Goals

- Identify your goals

List out anything you consider to be a financial goal. Some common ones include:

- Save for retirement

- Buy a house

- Start a business

- Save for a child’s education

- Pay off credit card debt

- Pay off student loans

- Quantify your goals by time and value.

For each goal, go through and figure out when you want to achieve it and how much it will cost.Example 1: If you listed “Buy a home” as a goal, you could say the time you want to achieve it in is 3 years and the value of the home is $500,000. And you can get more specific with how much money you will really need by figuring out how much you will spend on the down payment, furnishings and closing costs. From that number you can figure out what an appropriate savings rate would be to achieve that goal.Example 2: If you listed “Pay off student loans” as a goal, you need to gather all your loan information. You should write out who you owe money to, when it is due and how much you have to pay. This will make sure you have a realistic idea of what this goal looks like. You can reference this When Should I Refinance My Student Loans chart as well to help if you are looking to refinance your student debt.

- Prioritize your goals

Finally, number your goals from the most important to the least important. This is where you have to be honest and realistic. You may want to save for your child’s education but if you want to buy that house in three years, the child’s education savings may have to wait.

The financial goal planner worksheet can help guide you through this process of setting goals. By laying everything out on paper, you can see what matters most to you. This will then allow you to figure out how you want to allocate available savings towards your goals each month. Some sacrifice may be involved, but if you are honest with yourself during this exercise, you can find yourself on a straighter path to achieving your goals. See sheet here.

The financial goal planner worksheet can help guide you through this process of setting goals. By laying everything out on paper, you can see what matters most to you. This will then allow you to figure out how you want to allocate available savings towards your goals each month. Some sacrifice may be involved, but if you are honest with yourself during this exercise, you can find yourself on a straighter path to achieving your goals. See sheet here.