Heather loves the fall. From the leaves changing their colors to that certain crispness in the air, she can’t get enough of it. So far we’ve been to two pumpkin patches and one fall apple festival featuring a petting zoo. Hazel got to meet new furry friends. However, there was a pretty sad looking goat that may have contributed to a mid-grade fever. Fall is magical. I get it. However, for me, a Florida boy whose blood remains permanently thin, no matter how many winters he’s subjected to, I find the whole fall thing a bit strange. Why prey tell? Well, I think it’s because everything is changing around me and because I have no control over these changes. “Why is the warm leaving us?!”, screams my brain and body. These kind of changes just doesn’t happen down south. We have two types of weather. Hot and very hot. Sigh.

Heather loves the fall. From the leaves changing their colors to that certain crispness in the air, she can’t get enough of it. So far we’ve been to two pumpkin patches and one fall apple festival featuring a petting zoo. Hazel got to meet new furry friends. However, there was a pretty sad looking goat that may have contributed to a mid-grade fever. Fall is magical. I get it. However, for me, a Florida boy whose blood remains permanently thin, no matter how many winters he’s subjected to, I find the whole fall thing a bit strange. Why prey tell? Well, I think it’s because everything is changing around me and because I have no control over these changes. “Why is the warm leaving us?!”, screams my brain and body. These kind of changes just doesn’t happen down south. We have two types of weather. Hot and very hot. Sigh.

After trick-or-treating, we quickly move on from candy collections to turkey carving and holiday decorations. So, what does this mean for you and your personal finances? Well, I’d like to reinforce that it doesn’t matter what time of the year it is for you to be in control of your financial life! However, here are some key considerations before the ball drops in Times Square on New Year’s Eve. Around this time, many employers open up their benefit election periods. Now might be a good time to revisit cash flow/your budget to see if it makes sense to take greater advantage of saving vehicles like HSA’s and FSA’s or group insurance plans like life insurance and disability insurance. Some of these things could potentially provide additional tax savings. Wouldn’t that be nice?

Speaking of taxes (thrilling), when it comes to financial planning, tax planning is generally the largest area of focus at the year end. This is because there is a limited amount of time remaining to make retirement plan contributions and charitable donations or take advantage of tax loss harvesting in taxable investment accounts. These are just a few of the types of strategies that are out there so it might be worth making a call to your accountant not only review these items, but also to get an estimate of what your tax bill/refund might look like come April 15th of next year. There are still a few paychecks left to adjust your withholdings or quarterly tax payments so don’t delay. For my freelance hustlers and small business owners out there, check out my buddy Dave Burton, CPA‘s post over on his tax blog. He has 5 Year End Tax Tips for Statups and Freelancers.

Speaking of taxes (thrilling), when it comes to financial planning, tax planning is generally the largest area of focus at the year end. This is because there is a limited amount of time remaining to make retirement plan contributions and charitable donations or take advantage of tax loss harvesting in taxable investment accounts. These are just a few of the types of strategies that are out there so it might be worth making a call to your accountant not only review these items, but also to get an estimate of what your tax bill/refund might look like come April 15th of next year. There are still a few paychecks left to adjust your withholdings or quarterly tax payments so don’t delay. For my freelance hustlers and small business owners out there, check out my buddy Dave Burton, CPA‘s post over on his tax blog. He has 5 Year End Tax Tips for Statups and Freelancers.

Fresh Millennial Financial News:

Since we last met, there have a been a few featured articles worth checking out.

- The first is from CNBC on Why a Millennial Should Have Life Insurance. There are only a handful of reasons at this stage of the game. While I comment about life insurance from a business perspective, my general opinion is that committed couples seek affordable term life insurance.

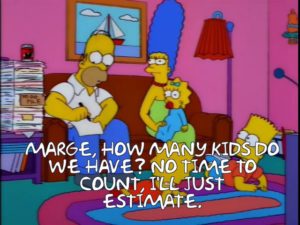

- Next up is a Q&A from Nerdwallet’s Ask Brianna called How Can I Afford to Have Kids?. I thought this was a fantastic piece addressing the concerns that many Millennials have when it comes to bringing a bundle of joy into the world. Thee words – master cash flow.

- Lastly, I weighed in on a MarketWatch article called, What to do With Your Home When Divorcing (If you’re not Brad and Angelina). Divorce stinks, but if it happens, and you have to deal with a home, the consensus is to sell it, split the proceeds and move on.

Well, let’s not end on a somber note and get ready for costume parties (Hazel has two costumes for her first Halloween, she’s going to be a candy corn and the Hungry Hungry Caterpillar) and for introducing an abnormal amount of sugar into our bloodstreams! Have fun and be safe out there!