Just a few months ago, my firm launched its first tactical portfolio. It’s a straightforward, rules-based market timing model a la Meb Faber’s Ivy Portfolio. While it’s not for all of our clients, it’s a great way to provide additional value in an increasingly commoditized area of financial services. I do believe traditional active management is bleeding a slow death, but I also believe that a rules-based active strategy complements our existing strategic investment offerings.

After launching the portfolio, I wondered what would happen if we became tactical with our firm’s mainstay strategic portfolios, like an *aggressive* 80/20 mix of stocks and bonds. If we tinker with those, can we can do better than simply buying, holding and rebalancing on an annual basis? Because outside of there being a change in your investment objective, we typically don’t make any big moves. Staying the course generally proves to be the right answer when things get wild, especially when investment time horizons are long.

But what if we moved up and down risk bands of a strategic model as a tactical strategy? Could we ever get the timing right to consistently beat the market? It’s unlikely, but I thought it would be interesting to take a look at what would happen if an investor went from a 100% equity portfolio to an 80/20 portfolio mix, and then back to a 100% equity portfolio at various times before the top of the market and after the bottom of a massive sell off.

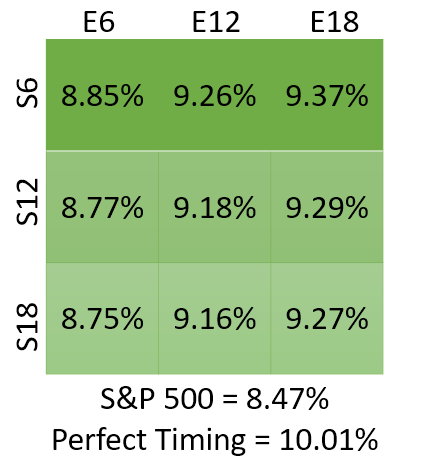

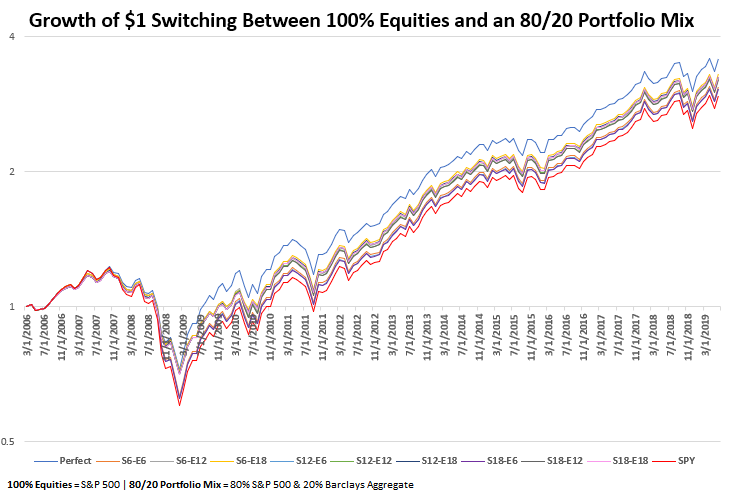

My data game isn’t as tight as some of my more quant-focused colleagues, so I enlisted the help of my friend Corey Hoffstein, CIO of Newfound Research, to help me crunch some numbers. Below, you will see the growth of one dollar if you switched from 100% equities to an 80/20 investment mix at 6, 12 and 18 months before the top of the market (S), and then switched back to 100% equities at 6, 12 and 18 months after the bottom (E). For giggles, I’ve also included perfect timing as well.

In all cases, making the tactical shift between the two risk bands would have resulted in beating the market. You could’ve been up to 18 months early or late at the top or bottom respectively and have outperformed the market anywhere between 0.28% and 0.80% annualized.

While 1.5 years might seem like a long time to make a move, I can assure you that in the world of buy and hold investing it’s a hot minute. Remember, most people were still licking their wounds well into the recovery and, sadly, some are still licking their wounds today. Let’s also not forget that these examples are staged on the backdrop of the The Great Recession where timing matted a lot less than any post-2009 dip we’ve encountered.

Then, there’s psychology. Before the crash, when things were going up, investors were at peak greed, unwilling to reduce risk. Oppositely, when the generational buying opportunity availed itself post-crash, investors were at peak nausea, unwilling to assume even so much as an ounce of additional risk. This dynamic is primarily why no matter how feasible a tactical strategy looks on paper or how much time you think you have, it’s always difficult to execute, especially without any rules in place.

Speaking of rules, exactly what rules could be put in place to signal the top of a market and impending global recession? Yield curves inverting? Maybe. And what marker would you use to let you know you’ve reached the bottom? A sustained amount of time spent above a certain moving average? I guess. You can be as creative as you like here, but I can assure you nothing will be correct one hundred percent of the time. I’ll go as far as to say nothing will be reliable enough to produce desirable results.

Perhaps then, the real determining factor in deciding whether to make a tactical shift with your strategic portfolio isn’t found within a set of rules or, god forbid, from trusting your gut. Maybe the decision comes down to a multitude of quantitative and qualitative factors such as your appetite for risk, economic outlook, income security, current physical and mental state and, most importantly, your financial plan. Perhaps.

Again, most investors will be better off adopting a strategy they can stick with. Being tactical requires greater levels of discipline to handle the increased investment and behavioral risks that are associated with it. Even disciplined investors with the resolve to allocate their money this way don’t go all in a particular strategy. It’s simply a piece of the overall puzzle. That’s because they know rewards don’t come without their risks or, as Corey would say…

No. 👏 Pain. 👏 No. 👏 Premium. 👏https://t.co/tuHwqpxwJe

— Corey Hoffstein (@choffstein) March 8, 2019