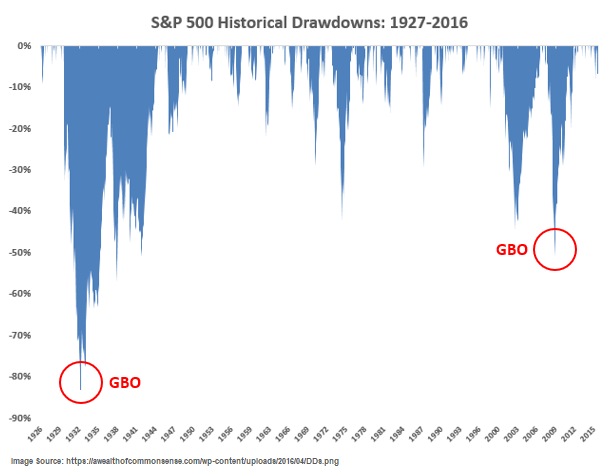

In finance, the term “generational buying opportunity” (or GBO, for short) is used to describe when asset prices have dropped so dramatically that it’s highly unlikely one will ever see them that low again. Hence it happening “once in a generation.” For some investors, even whispering this term makes the tiny hairs on the back of their necks stand up. Basically, it’s the mother of all dips.

The GBOs of 1932 and 2009 were the result of economic catastrophes. Thus, no one should hope for a GBO, and it upsets me when people characterize it as an attractive consequence of something bad. We cannot forget that in these dire situations, average people are less concerned with buying cheap financial assets as they are with saving their financial asses. There have been foreclosures, bankruptcies, divorces, breadlines and, worse, suicides.

Yet, some financial experts frame GBOs as enticing to young investors; people with time on their sides who can afford to “buy the dip” (not the drip) and wait patiently for the results. Highlighting this limited-time opportunity downplays how destructive the bottom of an economic cycle can be, and just because someone has less skin in the game, does not mean the sentiment is right.

Besides, seizing a GBO assumes that a young investor — or any investor for that matter — is capable of taking action. When my GBO occurred in March 2009, I was a fresh-faced 24 year old, who was more scared than confident in just about anything. Was I in a position to go all in on the market? Could I even afford to nibble? Could any of my friends? Nope.

I remember March 4th, 2009 like it was yesterday.

“Citi is at a dollar!” screamed an older advisor down the hall from my cubicle.

“But who’s got the brass to buy it?” I thought to myself.

I sure as heck didn’t, and I am pretty sure that no one in my office did, either. We were all too busy convincing clients that this wasn’t the end of the world and that they’d be okay. As for my friends, they were less concerned with cheap stocks than they were with finding cheap shots. Which bars we were going to hit up over the weekend was a more pressing issue.

Even the older financial professionals that surrounded me — the veteran advisors who’ve lived through a myriad of scary, albeit less dramatic, crises — were no better able to go on a buying spree than I was. We often fool ourselves into thinking that we’d be more prepared to deal with a situation having already lived through it.

Take raising your second newborn baby, for example. You think you’re going to do a better job at handling the sleeplessness, early morning feeds and stress of endless crying. But the reality is, you won’t. You are still going to get frustrated, lose your patience and beg your significant other to bail you out. (Unless you’re my wife, who is crushing her second rodeo.)

In the moments when you can feel your pulse throbbing in your ears, *knowing what to do* gets tossed into the diaper pail, along with the notion that you’d be able to act on a GBO. What you really want in that moment is for things to settle down and return to how they once were. You’re not looking for a deal; you’re looking for relief.

Let’s move on from treating and talking about GBOs as the silver lining to events we’d likely never see again and focus more on what’s in our control today. You can start by engaging in financial planning, increasing your savings rate and cash reserves and, most of all, better understanding yourself and your behaviors. Then, you’ll be ready when a good opportunity arises.

Now, let’s hear from you! Come join us in the sandbox.

What was your biggest missed opportunity?

— Douglas A. Boneparth (@dougboneparth) March 23, 2019