When we bought our home three years ago, I remember telling my wife that we would never again see mortgage rates this low. We had locked in a 30-year fixed mortgage at 3.65% with 10% down, no PMI. I remember telling her how lucky we were to be buying in this rate environment, despite the ridiculous home prices in the New York City suburbs. I further anchored myself to that belief as rates went jumping back to shy of five 5% just a few short months later.

Now, the 10-year treasury has *crashed* below 2% as mortgage rates continue their descent from their October peak last year. According to Freddie Mac, the average 30-year fixed mortgage is 3.6%. And with further rate cuts looming in the not so distant future, mortgages are poised to continue their downward trend to even lower levels. While this may become a tailwind for those looking to refinance their existing mortgage, I wonder if it will it be enough to turn Millennial renters into homeowners.

Let’s first look at the numbers. Below is a table showing the before-tax monthly cost of owning a $400,000 home using a traditional 30-year fixed mortgage at 2%, 4% and 6%. Let’s also assume a 10% down payment, property taxes of 1.5% and home insurance premiums of $1,000/year.

|

2% Mortgage |

4% Mortgage |

6% Mortgage |

|

| Monthly Payment |

$1,914 |

$2,302 |

$2,742 |

Of course these numbers alone won’t answer whether or not Millennials on the sidelines will become motivated to become homeowners, but it certainly tells us what it would take to afford owning a home. Keep in mind, however, the numbers neither reflect the additional maintenance costs associated with homeownership, nor do they account for changes in home prices due to economic forces like supply and demand. Nonetheless, all else being equal, paying $400 or even $800 less per month in housing expense is significant and, if rents don’t fall in tandem with lower financing costs, it makes a more compelling argument to buy.

Before you throw the whole “rent vs. buy” argument my way, please know that I don’t take too much stock in it. I do not view primary homes as investments whatsoever. To me, they are memory factories, shelters and solutions that solve life logistics like schools, additional space and increased levels of comfort. Besides, there’s no real practical way to calculate the ROI of living in a house over the course of a decade or two (or more). And even if there was, I’d tell you it’s infinity because there’s no value I could assign to the experience of watching my girls grow up under our roof.

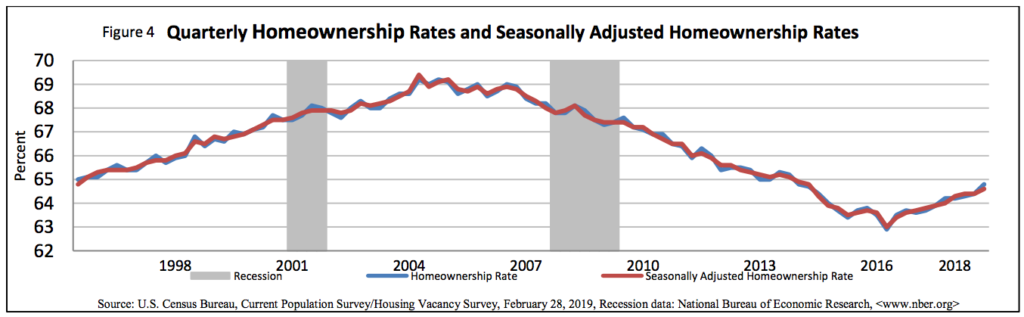

While lower rates may make purchasing a home more attractive, upticks in Millennial homeownership are more likely due to older Millennials (34 to 39-year-olds) finally being in a position to buy them. It’s been a long time since 2008 and the credit market is not nearly as tight as it was in the years immediately following the crash. The whole “Millennials delaying long term commitments” thing came to an end when a better capitalized and higher earning segment of the generation materialized. Therefore, I think lower rates may only support an already accelerating trend, at least for now.

Additionally, lower interest rates don’t only mean lower mortgage rates. It means more attractive financing options for other forms of debt, namely student loans. It will be interesting to see how banks and student loan refinance companies like SoFi react to a fresh set of historically low rates, and whether or not Millennials will favor student loan refinancing over mortgages. It will probably depend on the economy, meaning are we in a recession and, if so, how deep of one? Because when jobs go bye-bye, so do these low rate opportunities. Income is the Millennial’s blood supply and when shit gets real, who cares about asset prices and interest rates?

I guess that’s what makes this current rate environment so interesting. Rates are already so low pre-recession, which is why chatter of negative rates is becoming increasingly louder by week. What else is there to do before pressing the *helicopter drop* button that would be QE4? Can you imagine an environment where the economy is being propped by people and businesses getting paid to borrow? If the next recession is not a dumpster fire floating down a flooded street filled with pink slips, it could be the best thing that ever happened to Millennials.

A boy can sure dream because that probably won’t be the case and, for what it’s worth, I don’t think anyone is going to be handing you the keys to a house, a get out of debt free card or a $10,000 check every year any time soon. Then again, I could be wrong (and in some strange way hope that I am just because I want to see what would happen) but, even if I am, massive changes in monetary policy don’t happen overnight. The chips first need to fall and the damage needs to be assessed before any drastic measures can be taken. That’s what supposed to happen, anyway.

Millennials enjoy the noncommittal convenience that renting brings to their lives and yes, making great memories isn’t exclusive to homeownership alone. And while I don’t know what the future will bring just as much as the next guy, I do know that a great deal of Millennials, regardless of the stereotypes placed upon them, will pursue the great things in life sought after by our parents and grandparents. That means regardless of where interest rates are or how late into the 11th inning we find ourselves, homes will be purchased. Lower rates will only help those in a position to buy.

Come shout strong opinions into the void of the internet over on Twitter:

Homes are memory factories.

ROI = ♾

Rent vs. Buy is stupid.

— Douglas A. Boneparth (@dougboneparth) June 8, 2019