They say socially responsible investing (SRI) and Millennials go together like participation and trophies. According to a 2018 Harvard Kennedy School study titled “Money, Millennials and Human Rights”, SRI is getting a boost from Gen Y’s demand to establish a greater link between their money and their values. This increased demand, coupled with an alleged $30 trillion wealth transfer from Baby Boomers to Millennials, only further suggests that there’s a bright future ahead for socially responsible investing.

While I have yet to see this demand reveal itself in my own Millennial focused advisory firm, I don’t refute its existence or that it will show up in the not so distant future. I believe further evidence can be found in the “Millennials killed” narrative that continually pops up in your social media feed and in various articles. Yes, we’re painted as ruthless murders of product and industry, but the reality is that my generation isn’t disrupting retail shopping and dinner at Applebee’s for any other reason than there being better options available.

Sadly, this whole “Millennial killed” thing generally scapegoats an entire generation instead of intelligently discussing seismic shifts in consumer demand and preferences. As if we’re going to apologize for not wanting shove inferior and unhealthy food down our gullets? Like it’s our fault that we’re not burning gas to schlep to a store to buy something that be delivered in two days? Get out of here. Zero apologies given if you ask me.

Whether it’s in the next 5, 10 or 20 years, it’s only a matter of time before sustainable investing becomes, well, just investing. I can’t envision a world where my technologically woke cohort falls back in love with things like American cheese and motorcycles. Have you ever seen a Millennial sporting leather chaps on the back of Harley Davidson? I haven’t. Signals like these tell me that missing the trend away from, and out of, these classic American fixtures might wind up costing investors who fail to catch on.

So what’s stopping everyone from making the change to socially responsible investing and why aren’t my clients calling me on the reg to get in? Some of the prevailing, if not cliché, explanations have been availability, cost and performance. The thinking here is that most people don’t want to pay more for a limited offering that underperforms, even if it means doing something good. Humans never seem to fail at working against their own interests. Now, let’s look at each.

Availability used to be a valid reason not too long ago, but today there’s a robust offering of SRI products across the asset management industry. According to Morningstar there were 234 ETFs and mutual funds at the end of 2017 that invested in a socially responsible way. Their reporting suggests that the number of funds has doubled since 2012 primarily due to the dramatic rise of ETFs in the last ten years.

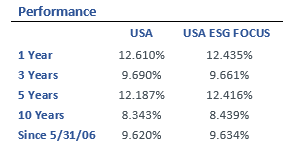

Claims of underperformance have been invalidated in legitimate studies time and time again. There’s plenty of available research suggesting that sustainable investing might even lead to outperformance. That’s compelling. I went as far as visiting MSCI, who has been a leading researcher in the SRI/ESG space for a while (and ironically sit one floor below mine) to see the numbers for myself. Sure enough, it checks out. Using their “total US market” data set, sustainable investing showed virtually no dilution in performance across all available time periods going back to mid-2006.

Lastly, while investment costs in any space vary from fund family to fund family, you can implement a fully passive/cost-effective approach to socially responsible investing. For example, BlackRock’s sustainable iShares lineup feature 12 ETFs with an average expense of 24bps (which includes two funds just south of 50bps). While it’s far from Fidelity’s new zero-cost line up of core index funds, their expense is inline with that of a diversified portfolio comprised of name brand ETFs.

So then, if we have the option affordably invest in a more responsible way without sacrificing performance, what’s preventing us from ingraining SRI in our standard allocations right now? Why isn’t every core equity fund swapped out with its socially responsible counterpart? Do we really not care enough about our future, our children’s future, society and the environment to make the conscientious decision to change? Are we all jerks? No. But I can’t speak for everyone.

Here are four possible explanations:

- No matter how compelling the story, SRI is relatively new and adopting a new standard way of doing things takes time.

- There are marketing issues given competing names and overlap associated with this style of investing (i.e. SRI vs. ESG).

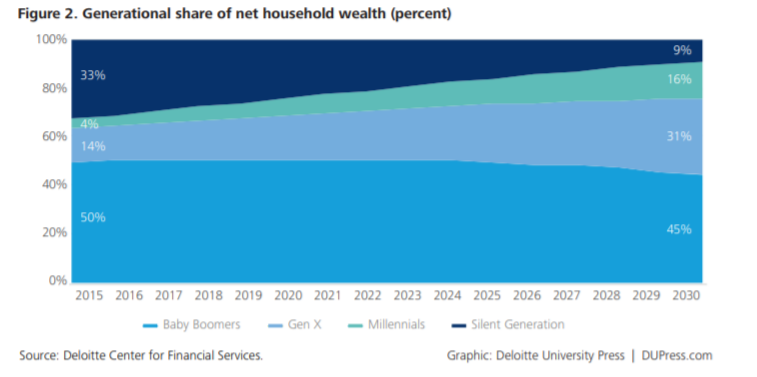

- For now, the investors who demand it the most (i.e. Millennials) have the least amount of household wealth to invest in it (see chart below) and

- Most financial advisors just aren’t talking about it with their clients.

With regards to the last point, I’ll be the first to admit that I’ve done a bad job discussing socially responsible investing with my clients. As a planning firm, we generally spend more time working on financial goals than we do portfolios. I much rather see someone focus on building a strong discipline with their existing strategy than introduce a new investment concept on top of it, even if its something as worthwhile as SRI. You have to remember that for most investors sticking to a strategy is hard enough as it is.

Let’s also not forget that it takes time for financial professionals to perform their own due diligence and become comfortable with any investment strategy before recommending it to their clients. Socially responsible investing doesn’t need to be an all-or-none commitment, but equipping one’s practice with the capabilities to implement these strategies takes time and resources, especially if offering multiple strategies. Realistically, advisors might need something more than comparable returns and a wholesome story before jumping head first into SRI.

Nonetheless, increasing advisor education around SRI (along with better industry-wide marketing) is something that can happen today. We don’t have to wait around for wealth to transfer from generation to generation to more quickly shift towards an arguably better way to invest. Moving forward, I’ll be doing my part to speak more with my clients about socially responsible investing. In the meantime, Millennials continue to Millennial by disrupting all the things. At the very least, I know I won’t be caught without my bathing suit when the tide changes.