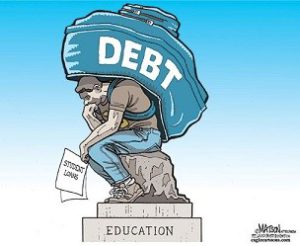

October 2017 marked the first time that borrowers could apply for Public Service Loan Forgiveness (PSLF). The PSLF program forgives the student debt of federal borrowers who, as Ron Lieber of the New York Times writes, payed their loans the right way, worked for the right kind of employer, had the right kind of federal loan and made the right kind of payments. As tricky as it sounds, one might hope that achieving loan forgiveness through a program specifically created for the benefit of public service workers would be straightforward and as painless of a process as possible. After all, the spirit of the PSLF program is clear: as an incentive for working for the good of the public, your federal loans will be forgiven tax-free after making 120 monthly payments. That appears to be pretty straightforward to me. However, achieving forgiveness has already proved to be anything but straightforward and we are only beginning to see how difficult qualifying for PSLF can be. Unfortunately, as more applications for forgiveness are submitted, I expect there to be a lot more tumult to come.

October 2017 marked the first time that borrowers could apply for Public Service Loan Forgiveness (PSLF). The PSLF program forgives the student debt of federal borrowers who, as Ron Lieber of the New York Times writes, payed their loans the right way, worked for the right kind of employer, had the right kind of federal loan and made the right kind of payments. As tricky as it sounds, one might hope that achieving loan forgiveness through a program specifically created for the benefit of public service workers would be straightforward and as painless of a process as possible. After all, the spirit of the PSLF program is clear: as an incentive for working for the good of the public, your federal loans will be forgiven tax-free after making 120 monthly payments. That appears to be pretty straightforward to me. However, achieving forgiveness has already proved to be anything but straightforward and we are only beginning to see how difficult qualifying for PSLF can be. Unfortunately, as more applications for forgiveness are submitted, I expect there to be a lot more tumult to come.

Opponents of the PSLF program will argue that it is not the government’s fault that borrowers didn’t adhere to the rules that were put in place at the program’s inception. It’s a valid point, but doesn’t it feel wrong to be a stickler for the rules given the somewhat altruistic nature of PSLF? It seems almost amoral to give these folks a hard time over something that can make or break their financial lives. Morals aside, we can also point to concrete instances where the rules don’t make sense. For example, let’s say you didn’t make the “right kind of payments” by failing to enroll in an income-driven repayment plan. Yet, in making the wrong kind of payments, you may have actually ended up paying more money towards your loans than if you were in the right plan because income-driven plans often afford borrowers smaller monthly payments than other more standard repayment plans. Therefore, it’s outrageous to deny someone from qualifying because they didn’t follow this particular rule.

At the very least, this one example is an oversight and will be corrected by amending the rules to allow payments from any repayment plan to qualify for PSLF. At the very worst, it demonstrates that the rules were designed to trip up public workers from qualifying all together and, while I’d love to think this and any other “errors” will be fixed as the volume of applications increases, I am not holding my breath as the future for the PSLF program and income-based repayment plans looks grim. According to a recent federal budget proposal, both programs are slated for termination. This would affect nearly 550,000 student borrowers and $108 billion in loans that are on pace for forgiveness, according to the U.S. Government Accountably Office. That’s more than half a million American working jobs that keep our country running.

In a more perfect world, shouldn’t our government be advocating for those who accepted the PSLF incentive? The spirit of the program suggests it should but, in reality, how could we possibly expect that to happen when the current administration’s view of public service appears to be more of a means to achieve power, popularity and control? How can we expect the spirit of the PSLF program to be protected when we’ve already seen how hasty decisions and selfishness have resulted in outcomes that don’t align with what’s best for the American people? Sadly, we shouldn’t. At the end of the day, violating the spirit of the PSFL program not only hurts the hundreds of thousands of Americans trying to qualify, but it also crushes the spirit of public service in general. That’s not great for America no matter how you cut it.

Most of my career as a financial advisor has been steeped in the world of student loans. I’ve built a business around helping individuals, mostly Millennials, tackle student debt. My wife and I recently wrote a book about the subject called The Millennial Money Fix. In it, we share our own personal relationship with student debt, which extends well into the six figures. We intimately understand the financial challenges facing millions of hardworking Americans and advised both new and existing borrowers not to rely on forgiveness programs, arguing that there is no guarantee they would exist in the future. We sincerely hoped our advice would turn out to be wrong. Unsurprisingly, and to all of our detriment, we’re witnessing just how right we were.

Related Articles

[Money Q&A] The Quick ROI Calculation for College Education

[Student Loan Hero] How to Win at Debt Settlement Negotiations

[Investment News] More Than Half of Student-Debt Borrowers Regret Going into Debt: FINRA Study