What’s your earliest memory? Mine is visiting my grandparents in New York. I must have been about four or five at the time. It’s all very hazy, but I vaguely remember rooms with those wooden paneled walls, eating Corn Flakes for breakfast, trying Juicy Fruit gum for the first time and these little animal stampers from our excursion to the Bronx Zoo.

While snuggling on the couch with my three-year-old the other morning, I wondered if she would remember anything from this time in her life. Would she recall the Nutella filled Silver Dollar pancake sandwiches I made? How about us watching silly cartoons together? I hope she remembers how I lift her high up in the air at school before her big hug goodbye.

It’s unlikely she will remember any of it. This is because of a phenomenon known as “childhood amnesia.” According to research from Emory University’s department of Psychology, children can remember events before the age of three but forget them by the time they are seven. Further research suggests this memory loss is due to the rapid growth of new brain cells during early childhood development.

I believe most investors suffer from a similar affliction called “investor amnesia”. However, unlike childhood amnesia, which happens once during a child’s early years, investor amnesia is a recurring malady throughout the investor’s lifetime. It’s the reason why so many investors are able to forget nine years’ worth of positive returns when a bear market rears its ugly head.

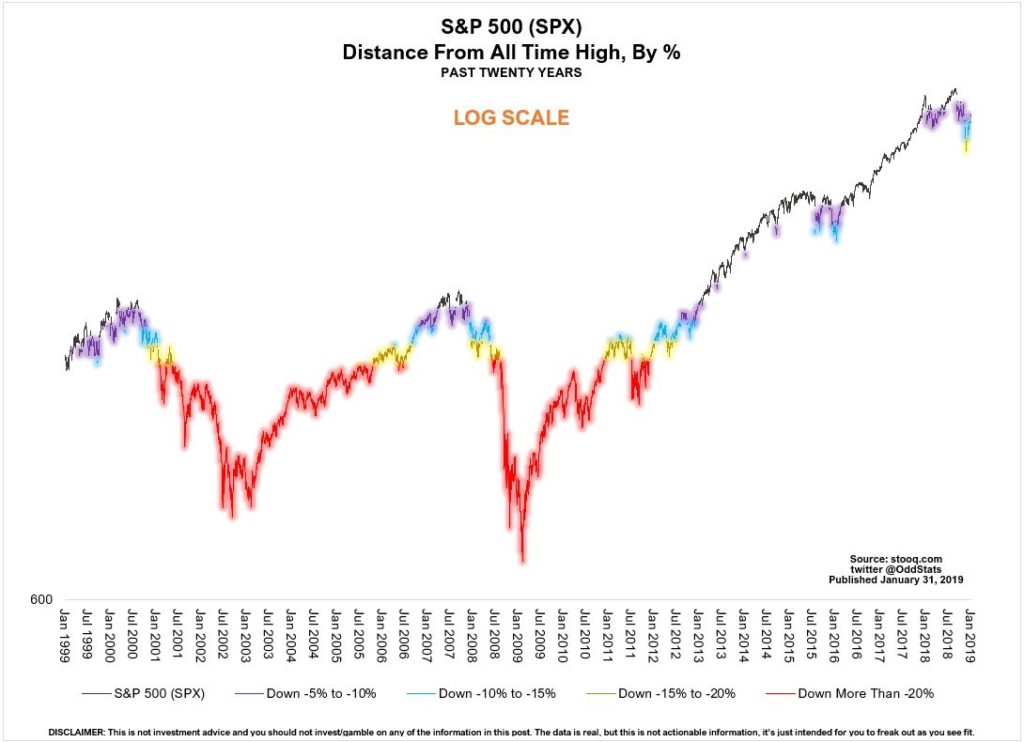

The chart above, compliments of OddStats, is a 20-year “pain map” of the S&P 500, showing both the length and various intensities of pain from any all time high. Meaning if you owned the index at an all time high, you can see how far it dropped from its peak and the levels of pain you would need to have tolerated to get back to the previous high.

Most glaring, of course, are the sections in red when the S&P 500 is more than 20% off its previous peak. Those represent the trauma of the dot com bubble and The Great Recession. Ouch. However, there are many more smaller pain points shown in purple and blue. These represent the little boo-boos and breakdowns along the way.

What’s fascinating about investor amnesia is that it not only causes long-term investors to forget their gains, but that it also has them forget about the pain they endured to receive them. Sure, they might remember the big ones, the trauma, but they easily forget the myriad of bumps and dips along the way.

With little small children, it’s no different. Little kids will likely forget all the boo-boos and breakdowns but, like investors, they too can retain memories of trauma despite their childhood amnesia. Studies taken years after Hurricane Andrew and the 2004 Indian Ocean tsunami have shown that young kids may actually remember the trauma caused by those natural disasters.

While having coffee with one of my mentees last week, I told her about my idea of this blog and asked her what her first memory was. Coincidentally, she told me it was from when she fell off the monkey bars and badly hurt herself on the playground. She couldn’t remember any other time she may have scraped a knee or got upset, but the monkey bar incident was quite vivid. Go figure.

While there is no cure for childhood amnesia, there is one for the investor amnesia. Thankfully, the cocktail of drugs to treat it were invented a long time ago and they haven’t changed since. Having a financial plan, sticking to your strategy, tuning out the noise, not checking your statements and staying the course are all made available over the counter. You just need to remember to take them.

A special thanks to OddStats for the chart. We might not know who he is, but he’s out there creating really cool stats, charts and content for others to enjoy FOR FREE. I really appreciate your help.

What did you have to say about it?

What is your very first investment memory?

— Douglas A. Boneparth (@dougboneparth) February 3, 2019