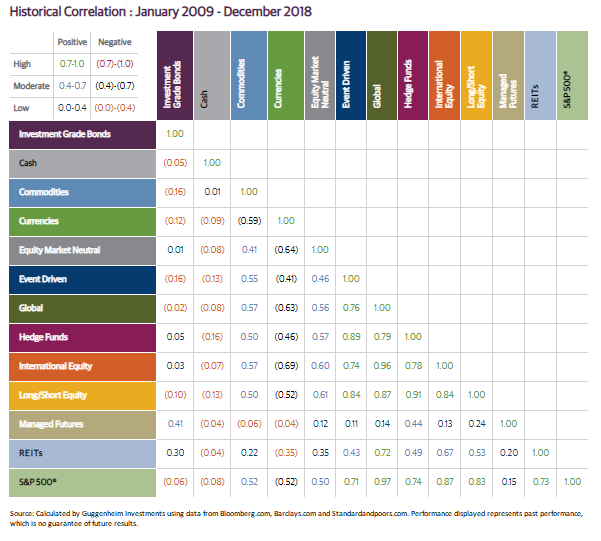

In investing, correlation tells us how an asset or portfolio moves in relationship to another asset or portfolio on a scale of +1.0 to -1.0. For example, over the last ten years, investment grade bonds have had a correlation of -0.06 relative to U.S. stocks (S&P 500). Meaning, if U.S. stocks went up by 1.0%, corporate bonds are expected to go down by 0.06%. But let’s not forget, correlation is not grounds for causation.

Nonetheless, at the heart of diversification is the addition of non-correlated assets to an investment mix. In doing so, we attempt to balance our risk by knowing that some boats (assets) will fall less dramatically than others when the tide inevitably goes out. Therefore, given a specific risk tolerance, adding non-correlated assets to a portfolio can reduce volatility and lead to better *risk-adjusted* returns over time.

In life, we strive to strike a similar balance of risk and reward. However, instead of maximizing a purely financial reward, we seek to maximize something far greater, our happiness. And instead of balancing the various financial assets in our portfolios like stocks and bonds, we try to balance the many facets of our lives like our health, family, friends, finances and careers. We can go as far as comparing the individual investments we choose to the specific decisions we make with regards to each facet.

Take health for example. Virtually every aspect of our lives is strongly and directly correlated to it. Without out health, we’re unable to do much of anything for anyone. Make bad investments here and your *boats* will fall proportionately. Make smart investments and your boats will rise just the same.

Conversely, not every facet of our lives is strongly or directly correlated to one another like health is. Perhaps an argument with an old friend during the week intrudes on your weekend plans, but has very little impact on your financial life. Like the relationship between domestic stocks and corporate bonds, the relationship between our friend and finances ins’t all that correlated.

Just like understanding how investments interact with one another helps reduce investment risk, understanding how the dimensions of your life interact reduce the risks we encounter on a daily basis. Ultimately, understanding these relationships allows us to set better expectations for ourselves, which leads to more productive allocations of our time, money and energy.

As we go about our lives, we have an overwhelming amount of choices to make. But we aren’t afforded the luxury of waiting to see how things turn out like we do with investing. Instead, we have to deal with our decisions in real time. It’s a perpetual balancing act that’s inherently difficult to manage. However, if we’re aware of how things are correlated, we might end up making better decisions and stand a greater chance of living happier lives.

What facets of your life are correlated? Come join the conversation.

What is your life most correlated to?

— Douglas A. Boneparth (@dougboneparth) May 5, 2019