When I moved to New York City in October 2008, I was terrified of becoming a kid who boomeranged. For those unfamiliar with the term, a “boomeranger” is used to describe members of Gen X and Gen Y who moved back home with their parents as a response to the Great Recession. It’s a term that bears a negative connotation since it’s typically associated with one’s *failure* to *make it* in the outside world.

For me, there was absolutely no way, after having the guts and nerve to leave the family business, I could go back home. I suppose I could have blamed it all on the Recession like everyone else I knew who made a round trip back to Florida. But I’m not convinced that the evergreen excuse would have made me feel any less embarrassed or ashamed of myself.

According to MarketWatch, the share of recent graduates moving back into their parents’ homes jumped to 28% in 2016 from 19% in 2005. While recession played a major role in this, other factors like expensive home valuations, student loan debt and underemployment have also contributed to the trend. Undoubtedly, last ten years have been financially challenging for Millennials looking to start their lives.

While skimming through the Real Estate section of the Wall Street Journal, I stumbled across an article titled “Rising Rents for Millennials Give Rise to a New Breed of Lender” which discusses a new type loan designed for recent college grads who need assistance making rent payments after moving to a high-cost city (i.e. NYC or San Francisco). The loans feature rates that are similar to credit cards; something in the neighborhood of 20%.

You already know how this story goes. Market a credit product in such a way that it appears to be a helpful tool when, in reality, it’s just a ploy to have individuals spend more money than they can afford. This time, the individuals are freshly minted college grads chomping at the bit to start their adult lives. They are the ideal target for making expensive apartments appear more attainable than they likely are. If you think this sounds oddly familiar, you’re not wrong.

Similar to student loans, these “apartment loans” do something worse than encourage bad financial behavior. What these loans do is make you turn off your brain by disguising the impractical as pragmatic. They trick you by making the unobtainable a possibility, which generates just enough excitement to forgo the easy math and critical thinking required to determine whether or not a financial decision is a smart one. But hey, you know what they say, if you can make *it* there, you can make *it* anywhere, right?

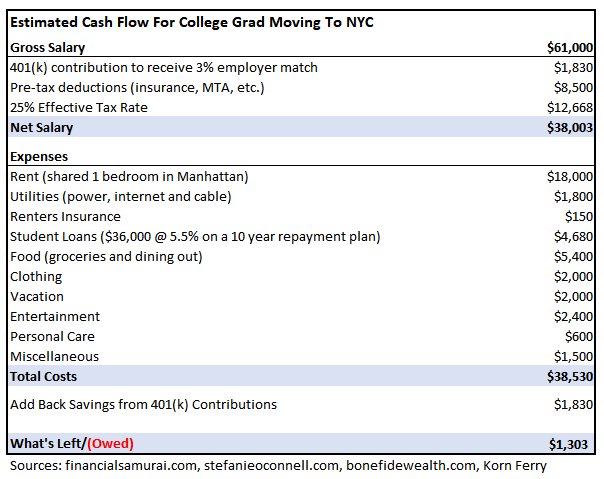

Financial Samurai Sam Dogen prepared an infamous cash flow breakdown of two New York City spouses *struggling* to save while earning $500,000/year. Now, let’s take the same approach, but examine the cash flow of a new college graduate who’s simply looking to stay afloat in a big city. Maybe we can have greater context around traps like apartment loans and, more importantly, the decision to move to there altogether.

I’m not here to tell you can’t make this work. In fact, this setup is surprisingly not too far off from what I worked with back in 2008. It can be done if you make some adjustments, like adding a roommate, packing lunches or skipping vacations. Depending on how much comfort you’re willing to sacrifice, you might even be able to find some meaningful monthly savings. Nonetheless, it’s a very tight budget, which offers little margin for error. One large unexpected expense or an abrupt change in employment status could have you packing your bags.

I have no clue where taking out a loan to finance an expensive apartment reasonably fits into any of this. It seems financially reckless to think leverage is going to make an already high-pressure situation easier. The risk is typically not worth the reward and, if anything, needing an apartment loan to make your move happen might tell you all you really need to know about your ability to afford moving.

This begs the question, is it even worth moving to a city you can just barely afford? Well, that depends. For those who know exactly what they want and have the determination to get after their “great things in life,” the opportunities found in a big city may be too good to pass up. Living lean and being slightly uncomfortable might go a long way in ensuring your survival. But for those lacking direction, discipline and purpose, it’s likely going to be an financial experiment you’re going to regret.

As a fresh wave of young adults graduate from college this month, I offer this unsolicited advice. Think about what it is you want for yourself. If you’re unsure, think twice before rushing to places like New York City, which are unforgiving (in more ways than one). At the very least, budget everything out prior to committing yourself to financial obligations like expensive rent. Stay clear of unneeded debt and know that there’s nothing wrong with taking the time to first build yourself a solid foundation. Above all else, know that it’s okay if you just go home. It won’t be forever.

What did you do after college? Was moving a home an option for you? Get in here.

After college you…

— Douglas A. Boneparth (@dougboneparth) May 17, 2019