As a generation, Millennials are unique. Our racial makeup is diverse. Our educational accomplishments are unparalleled. Our attitudes toward marriage are, let’s just say, overly cautious. Like I said, Millennials are unique group. However, it’s our resilience that makes us special.

Our maiden voyage into adulthood was immediately greeted by the rough seas of The Great Recession. Our futures quickly went from bright to bleak. While the damage was devastating, our ships sailed onward. The economy recovered and so did our long term prospects. Our heavy investment in overpriced and oversold college educations started generating positive returns. Some of us even managed to settle down, buy homes and start families.

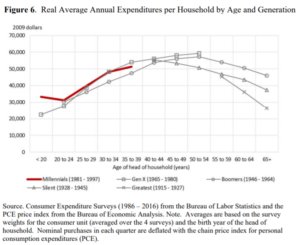

Let’s not call it a comeback though. According to a recent report titled “Are Millennials Different?”, the Federal Reserve found that, despite our generation’s tenacity to deal with economic adversity, Millennials have less real income, less assets saved and less wealth accumulated than older generations when they were young. On top of that, we bare a greater debt burden than our Baby Boomer parents did thanks to our “fancy” but “needed” college degrees.

Surprising, however, is that The Fed found that our consumer preferences are not too different than older generations, meaning that despite what you may have heard about our affinity to be frugal and cost efficient in everything that we do, we actually want to live a lot like our parents. It’s funny to think that we’ve been labeled as “entitled” when all we really want is what everyone already has. Never mind that our financial realities are arguably much more challenging than those doing the labeling!

So what does this all mean for Millennials right now? Well, it could mean that things are always going to be more financially difficult for us. We received a delayed start while corporations received a bailout. It could mean that if we expect to achieve financial goals similar to our parents someday (i.e. homes, families, financial independence), it’s going to be a lot harder to accomplish them. It could also mean that, come the next economic downturn, we’re still uncomfortably susceptible to being knocked off track and delayed once again.

It’s this last possibility that troubles me the most because, given our apparent financial disadvantages, it appears that Millennials simply cannot afford to experience another financial catastrophe. Our margin of error is extraordinarily thin as we still continue to dig our way out from 2008. And people wonder why we’re hoarding cash. Ironically, we now sit at the tail end of the recovery with no shortage of warning signs, ominous headlines and negative sentiment being rubbed in our faces on the regular.

The yield curve inverted? Uh oh! A recession is coming. Better go to cash with the investments we don’t have because this one’s going to be even deeper. We’re in a trade war with China? Yikes! Prices are going up. Better forgo my data plan and stock up on the essentials. Our President is leading us down a very dangerous path as a country? Dear lord! Better move to Canada because…well…MAGA! (Millennials Are Getting Annihilated)

These are anxious times, but don’t grab your passport just yet. There’s absolutely nothing guaranteeing that another Millennial derailment is imminent. In fact, the odds of bottoming out like we did during The Great Recession aren’t great. In all likelihood, the next downturn won’t result in rampant unemployment and a return visit to mom and dad’s basement. There’s a better chance that we will see the economy cool off, asset prices come down and new investments for future growth.

The Fed’s report did a good job comparing Millennial generational similarities and differences across the generations. Some of these differences, like our inherent diversity, are to be celebrated. Others, like having less real income and wealth, not so much. However, and more importantly, the report is an elaborate reminder that in order for us to remain special, we must do more than simply be able to get back up after being knocked down.

We need to take matters into our own hands since I doubt we will be getting bailouts of any kind in future. It’s up to us, and only us, to fortify our financial foundations with heightened levels of financial literacy, increased saving rates and smarter spending habits. We need to focus on these financial tenants in order to withstand both the dips and the drops we will surely experience along the way.