- Millennials and personal finance is my thing.

- So I love that this Axios article also caught the attention of Michael Kitces, Josh Brown, and Michael Batnick.

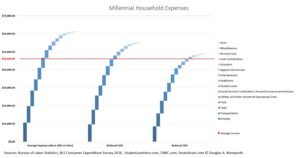

- I personally wanted to see where student debt repayment squeezed into the “average” Millennial’s cash flow and how much of a drag it really has on their financial lives.

- Then, I smashed a bunch of BLS data together and made this chart.

- The Micro: Student debt expense is significant, but stagnant wage growth appears to be the real troublemaker.

- The Macro: What savings? Millennials are actually taking on debt! Even the frugal ones!? Damn.

- The Takeaway: The financial realities and priorities of Millennials are different than other generations, while conventional rules of thumb related to savings appear to be antiquated and potentially insulting.

- Observation & Opinion: Younger Millennials (18 to 26-year-olds) distort Millennial data and I don’t like it.

- Fun Fact: This is my first chart. Here is my methodology.

Tell me what you think. Is student debt the “goal killer” I am making it out to be or is it just salt in the wound of stagnant wage growth? Is the average Millennial going into debt? Should I never make a chart again? I’d love to hear your thoughts.