The Future of Millennials

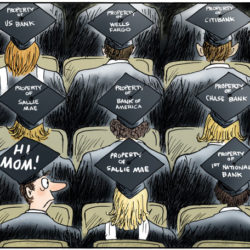

What does the financial future of Millennials look like? Does it look like a glass of our favorite Rosé or does it look like that half an avocado your forgot in the fridge? We are a generation with mountains of student loan debt, high unemployment for our age group and stagnant wages at the start[…]