During an interview with a reporter last week, I was asked what I thought was the easiest investment concept to explain. It was a fantastic question that momentarily put me on my heels. I knew there was no single right answer, but I began racing for one while I ran downstairs to grab a cup of coffee before a 10:30 am meeting.

“That will be $3.50 please,” said the barista at the cash register.

“Did the prices go up?” I asked surprised.

“Yes, just today by $0.25.” she replied.

“Inflation!” I yelped awkwardly, dropping the returned change into the tip jar.

After earning a confused look from the barista, I returned to my conversation with the reporter who had been forced into listening to the transaction though my headset. They quickly followed up from the original question.

“So, inflation then?”

Turns out, explaining the increase in cost of goods and services over time is easy. The day before, my cup of coffee was 7.14% cheaper than the $3.50 I had just paid for it. Ta-da! That’s inflation. Want to see that again? Okay. Go ask an old-timer what something cost when they were a kid — like a gallon of milk or a movie ticket. Doing so will earn you the same simple explanation but as part of a long story that begins with “Back in my day….”

Inflation is fundamental to investing. Because things cost more in the future we must earn a return that’s at least equal to inflation just to keep up with rising costs. Doing nothing with our savings literally makes you poorer over time, which makes achieving long term goals like financial independence much harder to solve for.

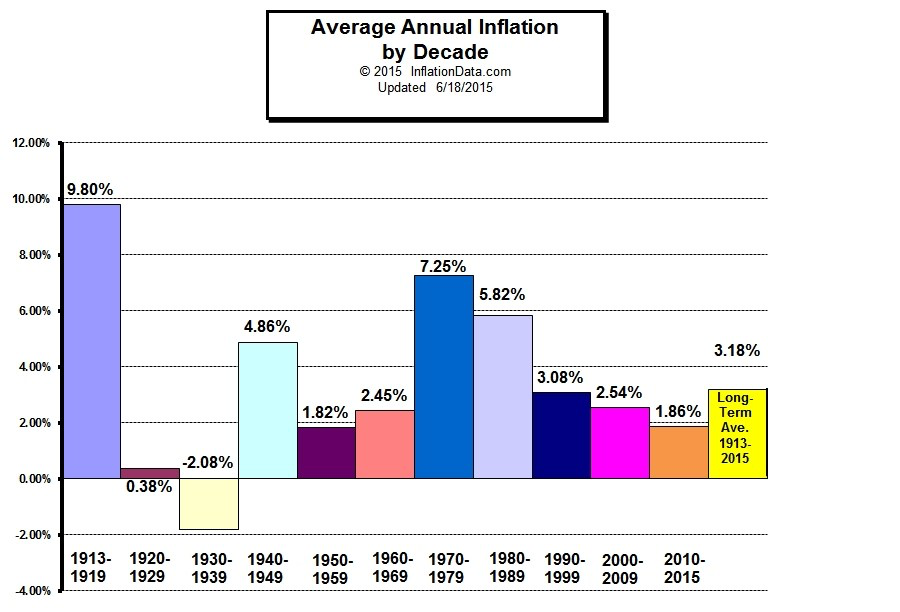

Last October, my colleague Tony Isola wrote a great piece about the impact of inflation on retirement income. In it, he described how “a 2% annual inflation increase destroys almost 50% in real purchasing power after 30 years.” That can be brutal for those living on a fixed income. It also caused me to wonder about more rapid increases in prices, not just the loss of purchasing power over a stretch of time. What about changes in inflationary environments like when things went from deflationary to inflationary during the 1970s and 1980s?

I can barely comprehend what those years must have been like and maybe I can glean some understanding from having paid for some already expensive diplomas but, outside of that, what would I know about investing or living in an inflationary world? What if it comes back? What do we do then?

To understand more about the investing component, I asked Ben Hunt, author of Epsilon Theory and frequent writer on topics of inflation and inflationary regimes, how young professionals and investors should think about this in the context of their portfolios.

In reference to his series “Things Fall Apart”, Mr. Hunt told me that “Getting the basic inflation regime correct – are we in an inflationary world or a deflationary world? – is the only question that a long-term investor must get right. Your investment playbook is entirely different in one regime versus another.”

Ben makes a good point considering that most long-term investment strategies in place now are likely not constructed for an inflationary world. What works today might not work in the future should we find ourselves in one. At the very least, we must be aware of our surroundings in case inflation forces us to change our long-term thinking and, subsequently, our investment strategies.

As for the living component, I asked my personal historian/father what it was like being a young professional during this time. He had this to share with me:

When I was your age, everyone was moaning about how expensive everything was. However, I don’t think people were feeling a lot of the stress on that front as wage inflation kept up with the higher cost of living. Labor became scarce and wages got bid up. Just before the impending recession hit we were at full employment so when the bottom fell out, the hangover was painful: layoffs, S&L failures, companies folding, markets adjusting. But why invest with rates where they were? Yet, smart people did and lost money. And let’s not forget about the impact OPEC and gas prices had. Also, there were lot of drugs – crack and heroin took the pain away for many, and a lot of users eventually felt no pain at all.

That took a dark twist, but my father paints a picture. Things, in many ways, appeared to be falling apart. But if there’s anything I took away from our conversation it was that he made it through the madness in one piece despite facing a confused economy riddled with inflation and risk. He simply dealt with it like everyone else. To me, that’s an easy concept to understand

I wanted to know what other people thought was the easiest investment concept to explain. I asked around. Here’s what they had to say:

What’s the easiest investment concept to explain to someone?

— Douglas A. Boneparth (@dougboneparth) January 19, 2019