Over the weekend, I learned of a 20 year old who died from suicide after thinking he racked up a $730K+ debit on Robinhood, a free online stock trading platform that’s become exceedingly popular with young “traders” placing risky bets on highly volatile companies amid the COVID-19 pandemic. Sadly, it was later revealed that the way the platform displayed account balances led the young man to believe he owed so much money.

This is both tragic and rare. According to the Aspen Institute, 16% of suicides in the US occur in response to a financial problem of some kind. And while there could certainly be more at play in this particular case than just the financial ramifications that come with placing some bad trades, it doesn’t replace the fact that financial access without knowledge can destroy lives and, as seen here in its most extreme form, can tragically end them.

Of course, financial professionals are by no means perfect either. There are no shortage of advisors who have led their clients into making really bad, life-altering financial decisions. But compared to Robinhood, there are greater stopgaps in place from traditional channel that make it harder for such extreme situations to occur. They range from entire in-house compliance offices and firm-specific account opening procedures, all the way down to the moral code of the investment advisor. There are generally more systems to ensure that everyone is protected.

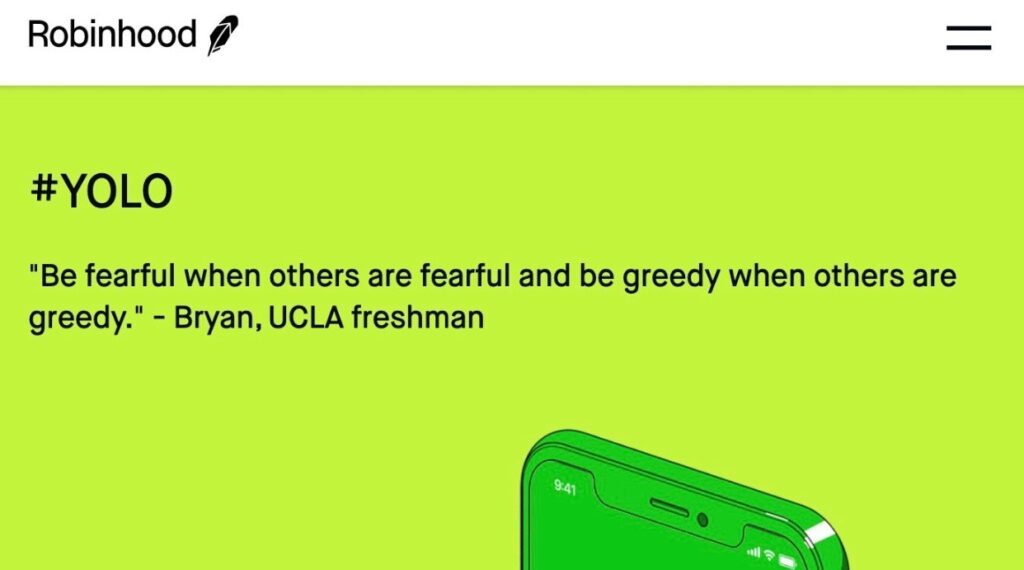

While Robinhood is not limited to young investors, its marketing is geared towards them. Ads like the one below not only tap into younger generations’ obsession with the fear of missing out, or FOMO, but they also harps on the more universal desire to get rich quickly. I believe this ad may have actually been created in response to, or in conjunction with, a number of jokes made at the expense of Robinhood by critics like me on social media.

Fueling the FOMO culture around investing and stocks are popular Reddit forums like WallStreetBets (WSB), which is known for sharing, if not boasting, aggressive trading strategies that all too often involve speculation using derivatives called options. Based on the number of its members posting screenshots of their winning and losing trades, it looks as if Robinhood is their platform of choice. The most popular posts are, of course, the ones showing the most extreme outcomes.

More recently, influential marketers and popular figures like Barstool president, David Portnoy, have been leading armies of day traders directly to Robinhood’s front door with his live-streaming schtick, Davey Day Trader Global. Both Portnoy and WSB have arguably catered more to the excitement of daytrading than its risks. Both appear to be hyper-trivializing the consequences of investing into nothing more than a casino game, where a mere “roll of the dice” can change your life forever. Ironically, Portnoy‘s war chest for trading stocks comes from a gaming and racing company’s $163M stake in his company.

Supporters will argue that Robinhood democratizes investing by giving people access. That people who’ve never had the opportunity to participate in the markets can now enter the game and grow their wealth. Fair point. But when you set the barrier of entry that low, what you end up doing is allowing people to believe that they can skip the fundamental concepts that protect them from making bad investment decisions. This is why I believe you must first earn the right to invest. Not to keep people out, but to help them stay in.

What’s taking place today with Robinhood is not too different from what’s already happening with student loans and higher education. Access to money is once again being paired with a style of marketing that can lend itself to bad decisions. The idea that earning a college degree secures you a good job is not too different from the idea that buying stocks will make you a bunch of money, especially when access and financing (via margin borrowing) is practically made available for anyone that wants it.

In our book, The Millennial Money Fix, we explored how unlimited access to student loans, coupled with marketing from colleges and universities, lends itself to young people believing that just because money is available, they should take it. Through our own personal experiences, we illustrated how sidestepping critical thinking, especially as it pertains to financial decisions, delays achieving your goals. We’ve emphasized the dangers that can occur when making decisions without the right tool.

But if this is all so dangerous, why is Robinhood in a position to offer this kind of access in the first place?

The biggest reason is because no one is stopping it. Financial technology often evolves more quickly than the rules surrounding the businesses or industries it is trying to disrupt. One could argue that the rules were never designed for this level of access. More than likely, they did not contemplate someone having the ability to establish an online brokerage account complete with margin privileges by quickly tapping and swiping your finger on a smartphone or tablet device.

Another reason is because Robinhood is not in the business of financial education or wealth management. It has no fiduciary obligation to ensure that its users’ interests are above the interests of its company. Make no mistake, Robinhood’s job is to provide access to the financial markets. Period. You can learn about its platform and how margin works on its website, but there’s no extensive effort to make sure that individuals fully understand the risks they’re taking when investing. That’s mostly on you, a newbie trader who flicked through a disclosure you probably should have read.

So, what can be done?

Acquire knowledge. Robinhood, like higher education and student loans, has illustrated the overwhelming need for financial education. Financial literacy is the single greatest shield for protecting individuals from making dangerous financial decisions. I created the idea of earning the right to invest as a way to encapsulate and implement all the basic financial lessons that will eventually lead you to accessing and investing in the markets. It’s a model that can be used by anyone looking to build, or teach how to build, a strong financial foundation.

From there, its users should encourage Robinhood to implement greater safeguards and controls like performing financial background and risk tolerance checks before allowing its users to borrow against their positions or use speculative products. If a non-income-producing 20 year old can believe he created a debt the size of a lottery jackpot, there’s clearly a problem. You shouldn’t need to be a fiduciary to want to prevent these types of misunderstandings from happening. I’d go as far to argue there’s more long-term value to be generated if Robinhood integrated a financial education program into its platform.

I pray we will not hear any more stories like the one shared over the weekend. But what’s most unfortunate is that it’s only when we hear about these extreme situations that we open our eyes to the very real dangers of providing access without knowledge. With student loan debt, the danger is already to the tune of $1.6 trillion spread over millions of young Americans. It, along with this most recent tragedy, serves as reminders that financial risks are all fun and games until someone inevitably gets hurt.

Come access and share your thoughts over on Twitter:

The market is down now, but remember that Robinhood traders don’t start waking up until about Noon.

— Douglas A. Boneparth (@dougboneparth) June 15, 2020