I came across an interesting article on MagnifyMoney.com titled “Where the Wealthiest Millennials Stash Their Money” that compared the top 25% of Millennial households with Average Millennial households. It compared things like how each group invests money, how their financial assets are structured and how their debts are structured. And like any good Millennial, I wanted to see how my financial life stacked up to others. Let’s take a closer look at how the richest Millennial families invest vs. how the average family invests and the debt of each group with the help of some handy charts from their article. Because who doesn’t love a good chart!

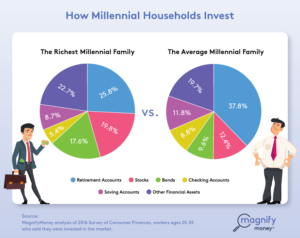

How Millennial Households Invest

Let’s start where I start with all planning before we can even talk about investing: cash reserve. The first thing that I noticed here is the differences between how much the Richest Millennials have in checking and savings versus Average Millennials. The richest millennials have 8.7% of their financial assets whereas the average Millennial has 20.6%. Why is it that the average Millennials has more than double their assets in cash than their higher earning peers? One theory I have is that even though the percentage is smaller, the richest Millennials have more money set aside in their cash reserve for emergencies. When an emergency happens, they can cover it more easily than their average peers. For an average Millennial family, an emergency like a car repair may tap out more of their savings so they have to keep more on hand. This leaves them with less to invest towards other goals.

Another thing you may notice when you look at the chart is the difference in assets in retirement accounts. You may look at this and think, good, the average Millennial is saving more of their assets for retirement than the wealth Millennial! But this can be deceiving. For the wealth Millennials, they may be hitting the maximum contribution limits on things like 401(k)s which for those under 50 is $18,000 for 2017. They are able to save less money into these retirement accounts so have to save more elsewhere. On the other side, you have the average Millennial with 37.8% of assets in retirement accounts, however they may not even be close to the maximum limits despite the higher percentage.

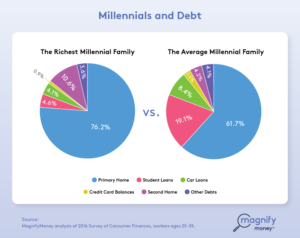

The Student Debt Factor

As you would have guessed if you have read some of my prior blogs or follow me on social media, student debt plays a big role in the financial lives of the average Millennial. Here we see that very clearly. It’s interesting that both groups have the same amount of debt in their primary home and student loans combined, 80.8%. Where the groups differ is the amount that is student loan debt. The average Millennial has more debt in student loans than those at higher income levels. I would guess that those at higher income levels have more income to pay off the loans sooner. Or that possibly those that are wealthier may have come from families that were able to pay for their education so they graduate without debt. Further, does growing up in a family that is well-off put you in a better position as an adult? I wonder if the reduction of the student loan debt for the average Millennial would have a similar impact on how their debt is structured? Would more go towards their home?

Either way, for the average Millennial family, having almost 20% of debt be student loan debt can be tough to manage. They are probably sacrificing other things because of it. Although we are already seeing the effects of student loan debt, only time will tell how badly the large amounts of debt will affect our economy.

Related Articles

[MarketPlace Radio] Millennials Get Serious About Retirement

[Wall Street Journal] Most Millennials Don’t See Becoming Millionaires, Study Finds