On Monday, there was this crazy article written by CNBC’s Annie Nova suggesting that more that 1 million people default on their student debt each year and, that 40% of borrowers are expected to default on their student loans by 2023! The article was based primarily on two different research papers. The more recent paper, titled “Underwater on Student Debt: Understanding Consumer Credit and Student Loan Default” came out earlier this month and is written by Kristin Blagg form the Urban Institute. The other paper, from January of this year, is titled “The looming student loan default crisis is worse than we thought” is written by Judith Scott-Clayton from Brookings. Let’s take a closer look at what they found.

Kristin’s Research

Kristin follows a 2012 entrant cohort (those having entered college) for four years and examines their default characteristics. She found that defaulting on student loan debt is highly correlated to borrowers holding, and defaulting on, other forms of debt. About 59% of borrowers who defaulted on their student loans within four years had debt collections in the year before entering repayment. Meaning people who have already defaulted on another obligation are very likely to default on their loans. It’s not a huge shocker that college students are making poor decisions with their money. After all, this is what happens when we enter today’s college setting financially illiterate.

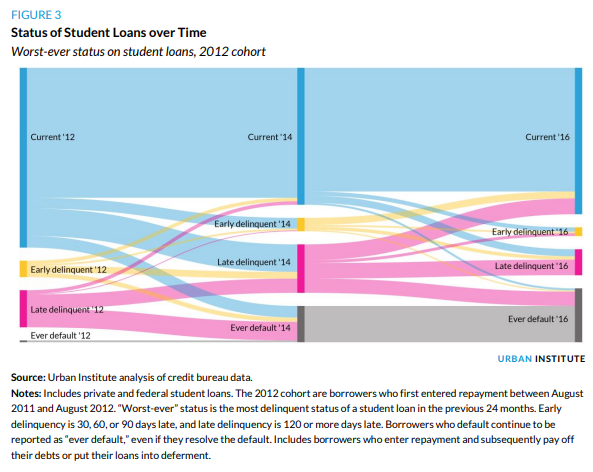

Kristin also found that people who live in underserved neighborhoods are more likely to default on their loans, but that one’s credit score is actually a stronger indicator of default likelihood. Below is my favorite chart from her report, which shows the status of the cohort’s student loans over time. By the end of four years, 22% of the cohort has defaulted once in the previous four years and it’s assumed they don’t recover.

Judith’s Research

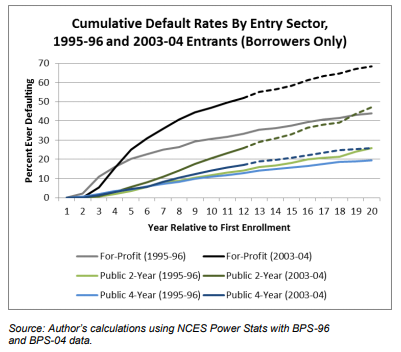

Judith looks at a more comprehensive data set featuring two cohorts (1996 and 2004 entrants) to provide “broader perspective on student loan default”. She found that default rates continue to rise between 12 and 20 years after initial entry and then goes on to extrapolate that data out to the 2004 cohort, which suggests that nearly 40% of borrowers may default on their loans by 2023!

Judith’s research is interesting in that we also get to see default rates across differing borrowing groupings (chart below). For example, entrants at for-profit institutions are four times more likely to default that two-year public entrants. For what it’s worth, I genuinely agree with her call to further regulate for-profit institutions. After all, Trump University was a thing. Additionally, her research concludes that defaults are highest among those who borrow smaller amounts and among borrowers of color, which was further echoed in Kristin’s research.

The Carpool Lane to Catastrophe

So, what’s going to happen as we continue to cruise down the streets of Default City? It would appear that we are on a crash course for economic disaster. “When is the student loan bubble going to pop?” is a question you hear a lot now. However, I am not so sure that the “bubble” is going to “pop” in a way that people think it will, which for most are recent memories of what happened in 2008.

Last I checked, most of the student loan debt portfolio is owned by the US government, which is a very different situation than mortgage debt owned primarily by banks. While unlikely to ever happen, I don’t see why Uncle Sam couldn’t write itself a check if it wanted to. In fact, my friend Katie Lobosco at CNN Money wrote this article on that very subject back in February. She references research from the Levy Economics Institute of Bard College which found that forgiving all student loan debt in the US would lead to an increase in GDP, a decrease unemployment and a “modest” effect on the deficit and inflation over the next 10 years. Seriously?! What are waiting for! I digress, because again, the chances of this happening are almost nonexistent.

Furthermore, in comparison to 2018, student loans aren’t being bundled, securitized and spread throughout our financial system like stanky CDOs were. I am not convinced that further (and even more extreme) student loan defaults would lead the near systemic economic failure of 2008, especially when there are other, more painful ways, for the government collect. As Bloomberg writer and fellow anime junkie Noah Smith points out in his opinion piece from March, “if the government wants its money, it usually is going to get it, even if that means ruining the lives of borrowers.” I believe he’s right. We’re talking everything wage garnishments to the revoking of various licenses and workers permits. There’s virtually no escape from your student debt, even in bankruptcy.

I am certainly not saying that spiraling default rates won’t take their toll on the economy. Student loans are already preventing Millennials from moving forward in their lives by delaying marriage, buying homes and having kids. That’s obviously not good when it comes to spending and economic growth. On average, Millennials are already doling out almost $4,000 in student loan payments each year. While that’s much less than what’s currently being spent on housing a transportation costs, it’s still a significant drag financially and, of course, defaulting on student loans will only make matters worse, especially when Uncle Sam comes looking to collect.

Practical Solutions

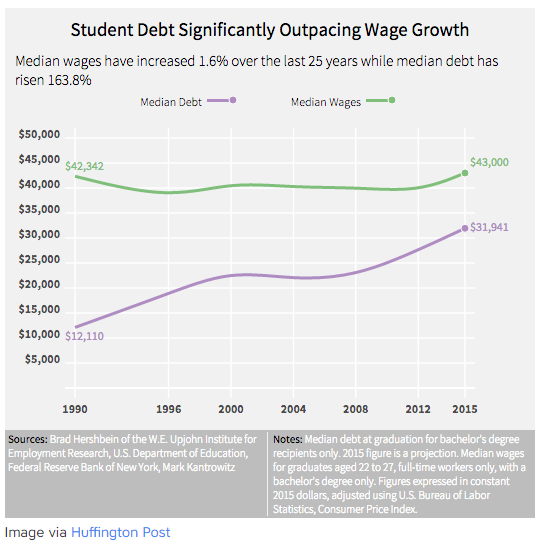

So, what can be done short of our government bailing out borrowers or restructuring the entire student loan portfolio? This is where a little tough love and some sacrifice comes into play. If you’re my fellow CFP®/homie Jon Luskin, you’d quickly point to people spending their money on stuff they don’t need (he used another word for it). New cars, out-sized housing and eating out were just a few examples. Jon’s point is only furthered by my fellow NYC colleague, Priya Malani, who, in this CNBC article, points to social media as direct contributor as to why we, especially women, spend the way that we do. I can’t help but to agree with my friends here and, while stagnate wage growth is perhaps playing an even larger in today’s difficult financial landscape, it’s safe to say we’re doing a pretty bad job of living within our means.

Sure, austerity is a good way free up cash, but I believe the real answer to solving our undeniable problem with student debt is through financial education. How’s that for a kick in the pants? We’re defaulting on loans used for education because we’re not educated. Both the reason borrowers find themselves in this position and the reason they can’t get themselves out is because we’re simply not equipped with the knowledge, discipline and skills to do so. Additionally, when it comes debt, we bury our heads in the sand by making an emotional and reactionary thing that’s easier to complain about than act on. However, it is from financial education that we become organized, make tough choices and ultimately execute on the things we need to do to improve our lives. What’s wrong with us?