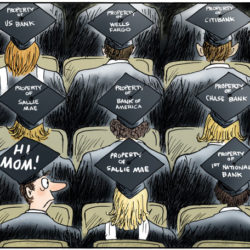

First Comes Love…or Career

First comes love…or does it? A lot of Millennials I know actually are putting career before love. I get it. Especially in a city like New York, I find so many Millennials that are incredibly driven and focused on crushing it in the business world. The entrepreneur mentality means that we become enveloped in our[…]