While reading about Bitcoin’s most recent plunge, I stumbled across a blog post from Charlie Bilello titled “Big Winners and Big Drawdowns”. In it, Charlie examined the massive, stomach emptying drawdowns experienced by shareholders of Apple, Amazon, Microsoft and Alphabet at various times throughout the last two decades. I heard that Amazon’s -94% dot-com bubble drawdown was so brutal it would have you begging for the S&P’s -55% drawdown from the Great Recession.

Indeed, it took a lot of guts to ride either of those positions all the way down and all the back up again, but it required nerves of steel to deal with the pair of drawdowns Apple delivered investors in the 1990s and again in the early 2000s. Yikes! I am sure investors didn’t find their appetite for months. Yet, any buyer of any of the aforementioned companies still holding their original position today is absolutely crushing it!

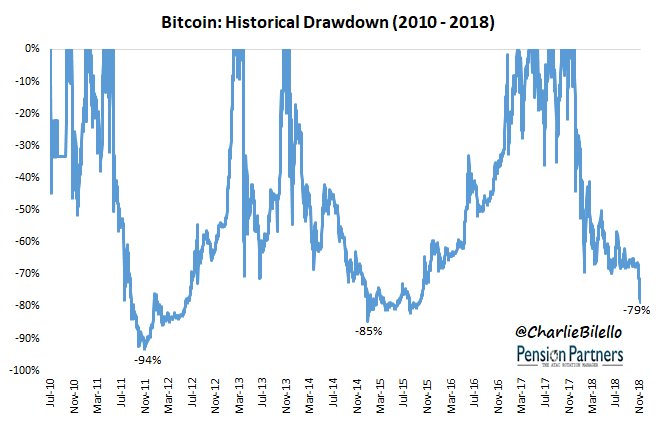

Which brings me back to Bitcoin. In less than 9 years, the leading cryptocurrency has experienced not one, not two, but three colossal drawdowns greater than 80%. That’s the equivalent of three Great Depressions worth of drawdowns in a relatively short period of time. Take that Apple! It makes you wonder, if Bitcoin investors make it out of this latest doozy, will their nerves even respond to so a 99.9% drawdown? At that point, will they even care?

Just because Bitcoin has been #blessed with a trio of epic drawdowns doesn’t guarantee its long-term success. After all, only hindsight tells us that Apple, Amazon, Microsoft and Alphabet are winners. Furthermore, Bitcoin isn’t a stock. It’s some kind of rare digital commodity that’s unlike anything we’ve seen before. It’s remains 100% speculative and anyone speaking about its future value in absolutes should be taken with a grain of salt.

Back in Charlie’s post, he observed something else about big drawdowns. Something more important. He noted that, whether his big winner big drawdown theory is true or not, it goes “a long way toward controlling your emotions”. That experiencing the suck of a massive drawdown can lead one to “becoming a better investor” by having simply gone through it. On this, I couldn’t agree more. It’s a brilliant thought which can also be applied to Bitcoin.

If anything, investing in Bitcoin is proving to be an excellent training ground for both investors and advisors deficient in their long-term investment discipline. I’ve personally seen my small position in Bitcoin go from a just few thousand dollars to over $110K, only to have it come gloriously crashing back down. I try not to feel one way or the other about it. Instead, I use it to remind myself of the holy relationship between risk and reward. I parlay my experience to further strengthen my own discipline. The one my clients depend on and pay me for.

Unfortunately, most of what you’re going to read about Bitcoin’s wild rides won’t focus on the silver lining found in any drawdown. What you’re going to read is likely some emotional click-bait article persuading you to either love or hate Bitcoin and its friends, the other cryptocurrencies. I guess this is really no different than almost any other emotionally invoking investment article splattered across the internet.

While I can’t speak for all investors of Bitcoin, I’m willing to bet that those who’ve experienced all three drawdowns won’t feel a thing when the next one comes. In fact, I bet they’re expecting many more wipeouts in these early days of crypto. Say what you want about Bitcoin. That it’s a bubble, a fraud, a joke or whatever. You might be right, but I’d admire any investor with an unwavering discipline to HODL no matter what because if Main Street investors could do the same with, say, their own retirement portfolios, then we’d all come up big winners.

This article is intended strictly for educational purposes only and is not a recommendation for or against cryptocurrency.