Back in 2016, when Heather and I wrote The Millennial Money Fix, the student loan crisis was an afterthought to both Democratic and Republican presidential candidates. With the exception of Bernie Sanders, the issue failed to make it to the top of the priority list of those running. Instead, other important issues like healthcare, immigration and tax reform were the primary focus in the 2016 election. So, when Sanders didn’t make the cut as the Democratic nominee, debt laden Millennials threw in the towel at the voting booth.

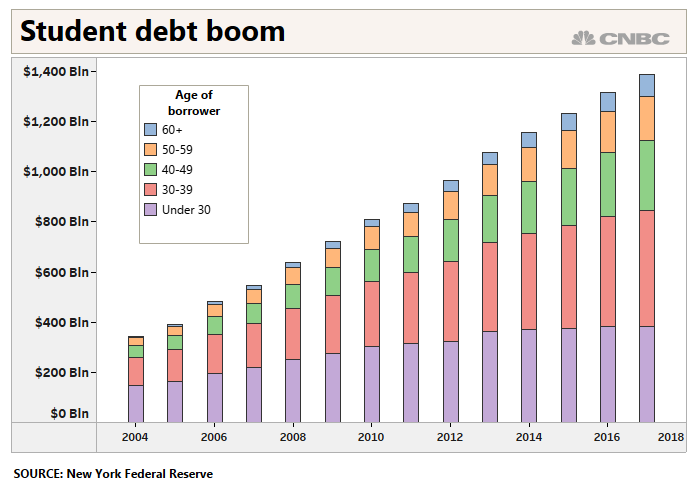

Since the time our book came out and now, the US student loan portfolio has increased almost $300 billion to a whopping $1.6 trillion. Now, student loan debt is larger than any other form of consumer debt in the US. With the 2020 presidential election on the horizon, several presidential candidates have now made the issue of student loans an integral part of their campaigns. The two most notable are Bernie Sanders (once again) and Elizabeth Warren, each touting similar loan forgiveness and free college tuition plans paid for by the wealthy.

With regards to loan forgiveness, the main difference between the two comes down to Sanders’s plan allowing complete forgiveness, regardless of one’s income or accumulated wealth. Therefore, critics of his plan say that this unfairly benefits wealthy borrowers because they typically have the ability to pay their loans, thus preventing low income borrowers from getting a leg up. Warren’s plan, on the other hand, places a $3 for $1 phase out between incomes of $100,000 and $250,000, providing *help* where it’s needed the most.

If I had to choose between the two plans based on the forgiveness component alone, I would choose Sanders’s on the fact that it doesn’t exclude student borrowers who are diligently paying off their loans due to their income levels. I believe it is potentially more harmful to financially and psychologically stymie their growth than inadvertently assist those who are wealthy to begin with. Penalizing those who are meeting their obligations by not also forgiving their debt would be a step in the wrong direction. It’s downright un-American.

On the tuition side of things, both plans offer free attendance at two and four year public colleges and universities. This component somewhat eases my biggest concern that any debt forgiveness also needs to address the problem that got us here in the first place; the outrageous cost of obtaining a college degree. Because without aligning the interests of the school and student, institutions will just end up charging more to the next batch of college matriculants. The cycle will just repeat itself. And, while free public school tuition won’t directly reign in the costs of attending private universities, it will indirectly force them to compete with a free college offering.

What doesn’t ease my concern, however, is the federal government allocating tax dollars to universities to subsidize the cost of free education. I think we all can agree that the government isn’t the best organization when it comes to efficiency and keeping costs down, so as the taxpayer now funding the country’s public college curriculums, I’d be concerned. Moreover, free education begs the question how dollars will be allocated in the first place? What criteria will determine which schools receive what subsidies? How will public schools compete for students and how will admissions or job recruitment work moving forward?

Offering free tuition would completely flip the world of higher education on its head. After all, this is no small change in how the current system works. On the bright side, perhaps it will prompt the more important discussion on how we approach equipping young men and women with the skills necessary to compete in today’s labor environment. Conversely, maybe elite academic institutions will further tighten their relationships with Fortune 50 companies, increasing the number of good jobs going to the students who attend elite schools. It wouldn’t be completely unreasonable to think that the wealthy would find ways to tilt the game in their favor despite the emergence of free college tuition. Yet more questions remain.

Will free college create a demand problem by sending more kids to school than classroom seats available? If so, it could further dilute the value of obtaining a college degree from a public university. And what about the messy business of unwinding the current debt portfolio? We haven’t even started to talk about the economic, if not systemic, ramifications that come with satisfying stakeholders of the institutions tied to student loan debt. What unintended consequences are in store for them and for us as a result? The questions go on and on, and we’d be fooling ourselves if we think they’d be answered in a campaign promise or a blog post.

Nonetheless, we live in a world where campaign promises are made to draw voters to the voting booth. And there appears to be no better lure for the Millennial vote than to dangle the idea of loan forgiveness. Look, I’m all for increasing young voter turnout and fixing the student debt crisis, but the mantra of loan forgives and free education paid by the wealthy will eventually need to be laid out in a more detailed way than simply saying the things young Americans want to hear. But that’s politics. We must not forget that these decisions can send shock waves through our financial system if they’re not handled properly and that’s bad news for everyone, not just the wealthy or the institutions that created the problem in the first place.

All is forgiven but never forgotten over on Twitter.

Sanders: Forgive all the debt!

Warren: Forgive most the debt!

Harris: https://t.co/jUTEFkc4nw

— Douglas A. Boneparth (@dougboneparth) July 29, 2019