When it comes to considering the future, many of us are only thinking about tomorrow, not 5, 10 or even 20 years in the future. This can especially be said for the younger generations. USA Today reports that Millennials are foregoing future planning until they’re married or have children.

When it comes to considering the future, many of us are only thinking about tomorrow, not 5, 10 or even 20 years in the future. This can especially be said for the younger generations. USA Today reports that Millennials are foregoing future planning until they’re married or have children.

Cue the Homer Simpson, “Doh!”

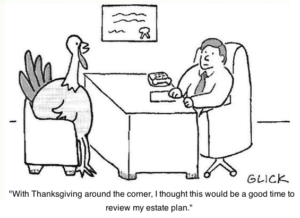

Making the decision to push off estate planning can put you behind the 8-ball financially or it can put you and your loved ones in an awkward position should your existing plan not be properly organized and executed. And that’s never good look. In fact, the consequences are often heartbreaking.

Why exactly are Millennials taking their sweet time with estate planning?

Some, especially the younger end of the generation, believe they’re invincible; immune to life-threatening illnesses or freak accidents. However, in the end, this mentality could leave your financial future in someone else’s hands, which is why it’s important to appoint trustworthy people to handle your estate if you can’t.

According to NYTimes.com, “When people do not specify their intentions, most state laws follow fairly rigid genealogical rules of inheritance and chew up time and money in the process.” Well, that’s not good!

Typically, for people who are unmarried or unattached, their first choice for their heirs (or beneficiaries) are a longtime companion, close family members—such as a nieces or nephews—and siblings, followed by parents, other relatives, then friends. However, without expressly stating your intentions, there’s no guarantee that your wishes will be fulfilled.

While considering the right person to inherit your assets can be daunting, the decision to choose a medical or financial agent—should an ailment preclude you from making medical or financial decisions for yourself—can be even more difficult. However, the alternative of not choosing anyone is far, far worse than the difficult decision of who to choose. By the way, you can always change your mind if need be, so no excuses, okay?

To properly handle estate planning matters, seek the council of a trust and estate attorney, financial advisor and accountant to handle the legal and financial tasks involved in establishing a formal estate plan. When thinking of people to appoint as your agent for medical and financial decisions, remember that appointing relatives or close friends who are geographically nearby and have enough time are typically your best bet.

With all that said, why is important for Millennials to plan their estates? Because this is your future. You never take safeguarding it lightly. For more information and some super helpful tips on how to plan for your estate, check out my other estate planning features including:

[The New York Times] Estate Planning for the Never-Married

[Millennial Magazine] Hey, Newlyweds! Start Planning Your Estate

[Daily Finance] 6 Estate Planning Moves You Should Make In Your 30s