Like most warm-blooded Americans on the day after Thanksgiving, my wife loves Black Friday. As I write this, I am currently staring at her from across my in-law’s living room while she lives her best online shopping life. She’ll scour the internet looking for the best sales for the things we need. While she might apply a more liberal meaning to the word “need,” I can count on her to spend responsibly.

Sorry retailers, you’re not going to make spendthrifts out of my household!

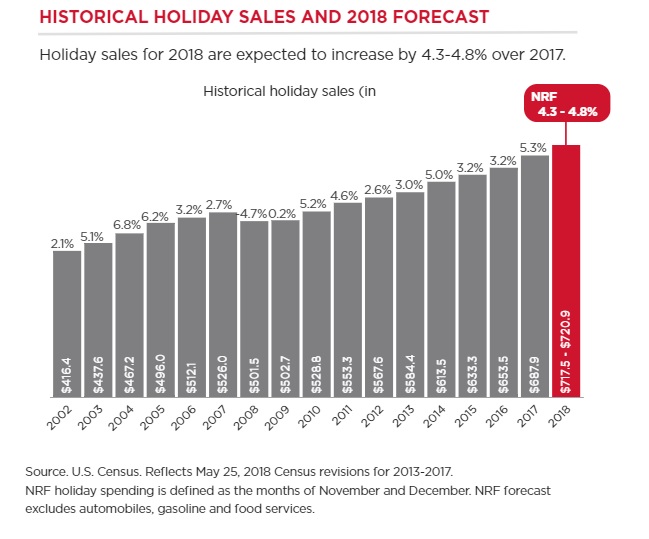

Last year, 137 million people left the comfort of their homes to hit the stores over the four-day Black-Friday weekend and kick off their annual holiday shopping. According to Adobe Systems Inc., online sales experienced an increase of 18% to $7.9 billion, with almost half of those purchases completed on mobile devices. This year, holiday shopping forecasts (see below) remain positive despite current economic headwinds like tariffs and the trade war with China.

Black Friday and holiday shopping are shining examples of our country’s obsession with consumption and consumerism. And this year is no different as holiday shoppers are expected to spend over $1,000. If you’re interested in “How This All Happened,” I highly suggest you check out this post by Morgan Housel, but we’ve basically become conditioned to shop ‘til we drop.

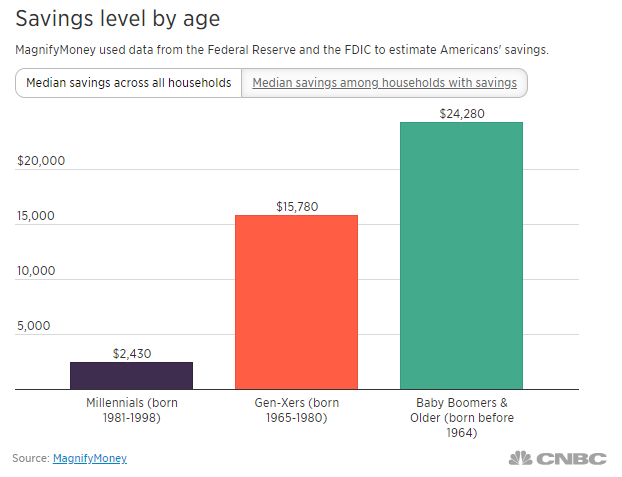

Now, before I Grinch the gift wrap out of your holiday shopping spirit, let me go on the record and say that I have no issues with splurging a little on the ones you love, especially when budgeted for. However, it doesn’t replace the fact that, regardless of age, we’re pretty terrible at saving money, thus making it all the more concerning that our priorities are on spending rather than saving. Sadly, donning a new Apple Watch today feels better than having financial greater financial security tomorrow.

Hasn’t this gotten old yet? Is giving into our consumer spirits still that much more exciting than avoiding financial hardships or realizing our long-term financial goals? Clearly, the answer is ‘yes’’ since we’re about to, once again, break all Black Friday spending records. The chemical release in our brains becomes too strong when you mix sleek looking goods and gadgetry with steep savings and discounts. Our conditioning takes hold. Spending is inevitable.

Before writing this, I envisioned a ridiculous world where Black Friday isn’t about spending money. In this world, the day after Thanksgiving is called Green Friday. It’s a day dedicated not to shopping, but to — don’t laugh — saving and improving one’s financial life. We wake up early from having spent the previous day eating well and exercising — please stop laughing — to find our inboxes flooded from banks that are practically begging us to take advantage of an extra 2% APR on a 12-month CD, no strings attached.

On Green Friday, brokerages run BOGO promotions on fund purchases up to $1,000 dollars, prudentially limiting investors to major index ETFs of course. Financial advisors slash their planning fees by as much as 50%. “Oh, the humanity!” we scream when we learn about the young man that got trampled to death when attempting to be the first to enter his local bank and fill out a deposit slip! Tragic, but we take comfort in learning that he held adequate life insurance, leaving his wife and children in a strong financial position.

That went from “haha” funny to “haha” dark very quickly. Indeed, living in an alternate reality where Green Friday exists is a bit silly, but what does it say about our reality? We’ve literally produced so many Black Friday fiascoes that news organizations now provide us with fresh video content on how to avoid becoming seriously injured when the store doors finally open. There’s even a website dedicated to tracking Black Friday fatalities and injuries.

While Black Friday and Green Friday are both similar in that they are extremes versions of one another, the main difference between the two is that almost no one would argue against a day that puts your financial well-being at the absolute top of your priority list. Moreover, there would be very few qualms in returning to a norm that has us adequately saving while also increasing our savings rate each year. It’s ridiculous, I know, but at least it’s not impossible like Analog Monday or Taking Tuesday. See what I did there?