Well that’s one month down and 11 to go here in 2016 and I am sure glad I didn’t make getting in shape a resolution because I’ve spent exactly ZERO minutes in a gym this year. I honestly don’t feel great about that considering how hard I worked out last year. Baby steps, Douglas. Baby steps. See what I did there? I also don’t’ know how I feel about this whole #DadBod thing either. Someone made a joke once that the Dad Bod is just male privilege in disguise. Thinking about it, maybe that wasn’t a joke and they were serious. Uhh. Anyway, as long as the suits fit, everything’s legit. That’s what I always say! *heavy breathing ensues*

Speaking of New Years resolutions, I am not a big fan of them and you can read more in my latest New York Daily News Article where I have resurfaced as a contributor for their new online Daily Views section. There, I take a second crack at some tips for a financially empowered new year in hopes that readers will get off their bum-bums and do something about their personal finances this year. It’s not like we’re taking about achieving financial goals and the great things in life or anything. As Shia LaBeouf would say, “JUST DO IT!”. He’s funny.

Reuters published this article on the ridiculous number of Millennials who have used payday loan services and pawn shops for cash needs. I tweeted and posted that this is fiscal irresponsibility of the highest order. While I was happy to weigh in on the article, I was completely devastated by what the PwC study, which the story was based on, revealed. Apparently, nearly half the of the Millennials surveyed could not come up with $2,000 if an emergency arose, leading them to utilize these services of last resort. Is this because of our lack of financial education or just a display of how difficult it is for the average Millennial to accumulate savings? It’s probably both. What do you think? Are we that bad?

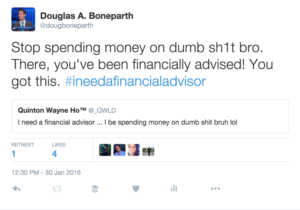

Sorry Quinton. You kinda asked for it.

I haven’t shared this with anyone yet but from time to time I search, “I need a financial advisor” (#INAFA) in the Twitter search box. The results are always amazing and often hysterical. Most of the time folks are tweeting this line after what appears to be overspending, from shoes to food, or after a big night out on the town. A popular request from #INAFA claimers is to request that a financial advisor needs to follow them around at all times so they don’t make bad financial decisions. Sounds fun, and I wish I could do this for a day, but the hourly rate for me to do that would be a bad financial decision in of itself. Not surprising is that a good swath of those tweeting #INAFA are calling for free services. I get that. We all want free stuff, but that’s not quite how it work (unless you’ve got that sweet, sweet potential I keep talking about).

Well, as you know, I am a man of the people and I never want to disappoint a crowd. I’ve also been known to fetch a laugh or two, so I respond to these cries with #ineedafinancialadvisor. Most of the time, I provide a serious reply and a suggestion that they check out the web site where they can get all this FREE content *drools like Homer*. Sometimes, however, going for a ha-ha is just too tempting, like my tweet above. You see that?! Four likes and a RT! Killin’ it. Thats a new record for #INAFA! Isn’t social media just FUN? So, tweeps, next time your spending is out of control and you feel like tweeting for help from an FA, you just might get a response.

See you all in February! Don’t forget to reach out, visit me on Twitter or Facebook or request a complimentary consultation.

-D.A.B.