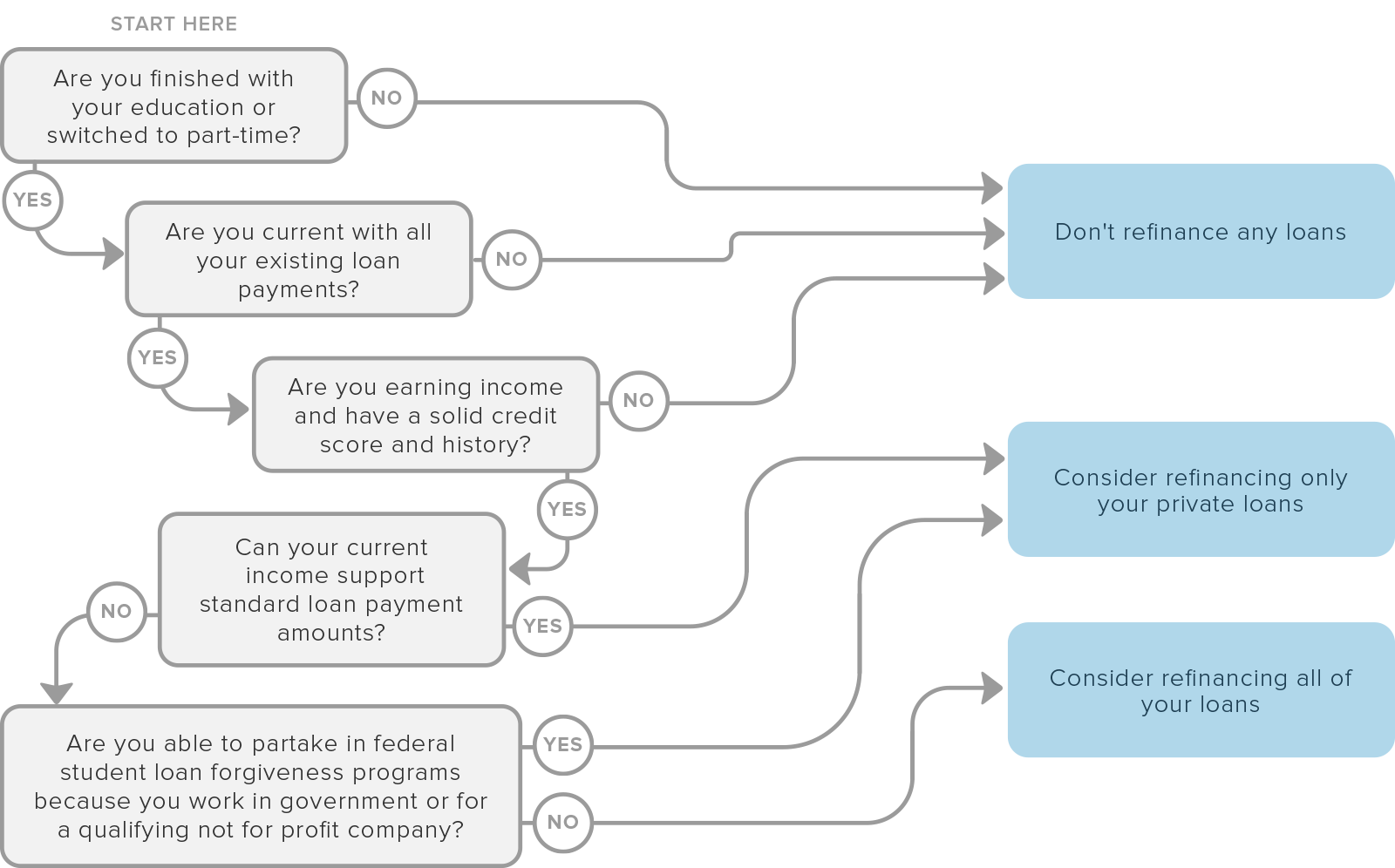

If you are a Millennial asking, “Should I refinance my student loans?” look no further. The infographic below will help guide you in this decision-making process.

The first question is whether or not you are finished with school. If you aren’t done, you are likely not ready to refinance. If you are, then you need to get organized with your current loans. Make a list of all of your loans. Write down who you owe, when it needs to be paid, what the interest rate is and the total amount outstanding. By fully understanding your obligations, you can finally take ownership of your debt.

If you are behind on payments, then you should take some time to work on your budget. Review what you are making versus what your expenses are and find a way to get current on your loan payments. If you are current with your debt and have a good credit history and score, then you could can advance to the next step.

Now, look at your budget and determine if your income can support standard loan payments. Here is where you can see why being organized with your finances both loans and general budget is key. If you can support standard loan payments, then you can consider refinancing your private loans.

If you can’t afford standard loan payment amounts, then you need to see if you can partake in any federal student loan forgiveness programs. You may be eligible for these programs if you work of a government agency or certain types of non-profit organizations. You generally also have to be working full-time, have made 120 qualifying payments and be repaying your loans on an income-driven repayment plan. As you can see, qualifying for these programs isn’t easy and requires a lot of work so do your research.

If you do qualify, then consider only refinancing your private loans. If not, then possibly consider refinancing all your loans. When you are ready to refinance, then head to Google to start researching providers to refinance student loans. A good place to start would be Student Loan Hero. They have tools to compare what companies are offering, how much your payments would be and much more. Make sure you compare rates and terms to see that you are getting the best deal.

Since student debt can delay achieving the great things in life, it should be a top priority and something you’ll want to get started on solving today. There are many options out there to educate yourself, but you can take some simple steps to get started. For many of us, we are left with a financial reality that we must face head on. I hope the tips offered here and the infographic below are helpful in putting a system in place to pay down your loans while also moving you closer to achieving your financial goals. You can download a PDF version of the Infographic here.