Here is your guide to establishing your financial foundation.

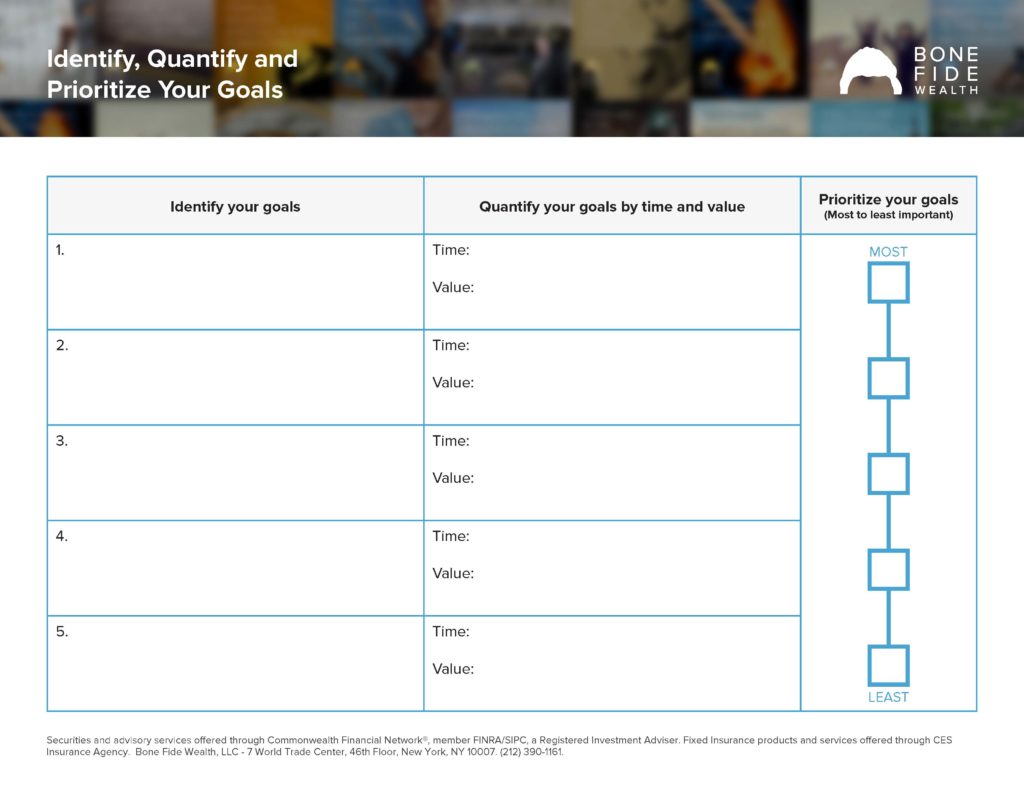

Step 1: Identify, Quantify and Prioritize Your Goals

The Financial Planning Launchpad provides a complete system overview and works hand-in-hand with the Goals Worksheet to put your financial goals in to action.

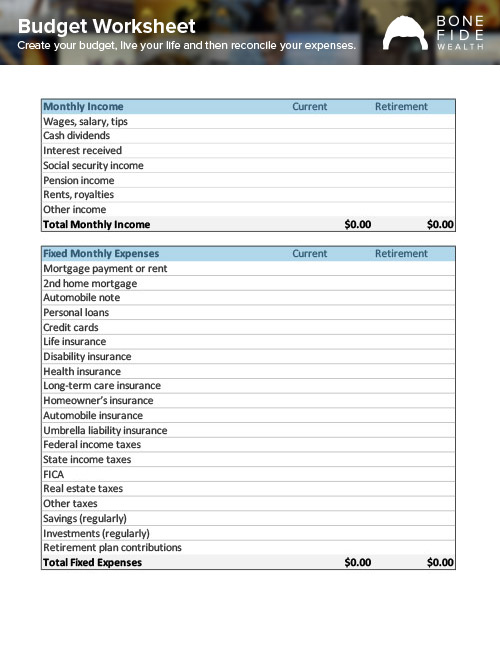

Step 2: Master Cash Flow

Build discipline in your spending and savings. Create your budget, live your life and then reconcile your expenses. Rinse and repeat every three months for one year. It’s not fun. We get it. But hey, masters don’t skimp on their training!

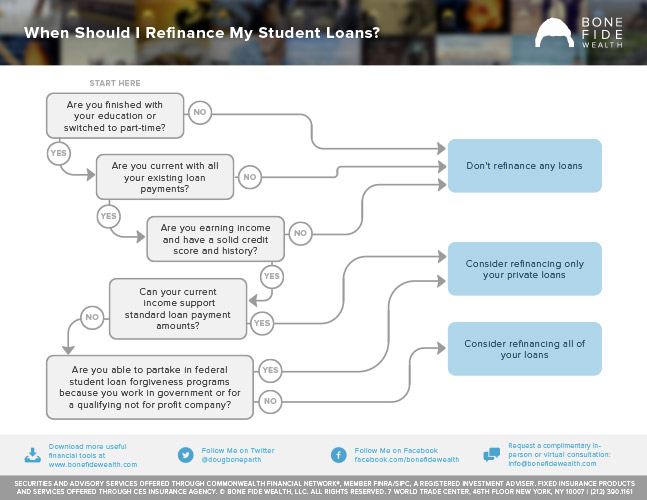

What’s that? You got student loans? Should you refinance? Great question. We got you covered with our Student Loans Infographic.

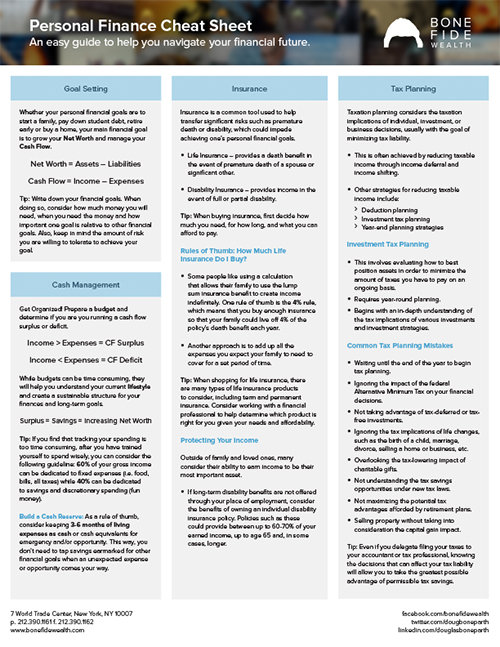

Step 3: Empower Yourself with Personal Finance

DIY

If you’re not ready to work with a financial advisor or you just rather do things on your own, we understand. Use our Financial Planning Cheat Sheet to take your financial education to the next level. Learning about the key areas of personal finance is just a click away.

Financial Planning Cheat Sheet

or

Hire a financial advisor

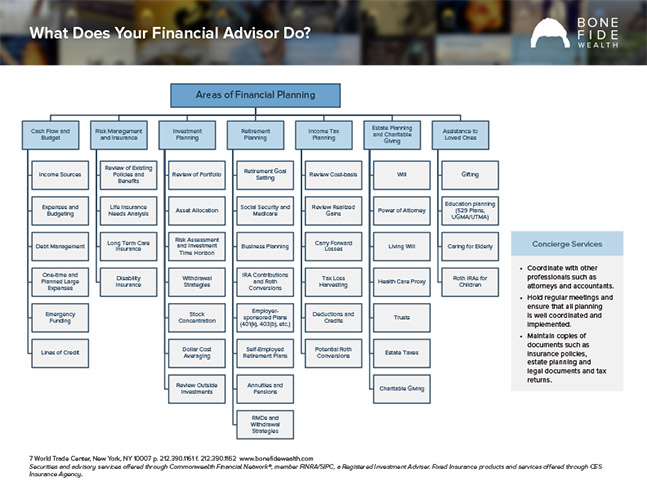

If collaboration is more of your thing or you simply don’t have the time in your busy life, then check out what a financial advisor can do for you. Feel free to schedule a complimentary consultation with us. We’re always happy to #InvestInYou.